Tax debt: How to Manage it Effectively

Patrick Gordinne Perez2024-11-11T19:05:38+00:00Tax debt is a relevant issue for many taxpayers.

Complying with tax obligations is essential to sleep soundly, but sometimes problems arise that lead to the accumulation of debts.

This article details the types of tax debts, how to consult them, the payment options available and the consequences of not paying them properly.

It will also discuss useful tools for managing these obligations effectively.

But it is clear that the best way to manage debt is to repay it.

Typologies of Tax Debts

Tax debts can be classified into different categories, depending on their nature and the type of tax liability that has not been fulfilled.

The main types of debts that may affect taxpayers are described below.

Tax debts

One of the most common types of debts owed to the Spanish Tax Administration Agency (AEAT) relates to taxes.

These debts can arise for various reasons:

Income Tax:

Individuals and legal entities that fail to make payments corresponding to the self-assessment of income tax may accrue debts which, in addition, include default interest and surcharges.

Value Added Tax (VAT):

Again, failure to submit settlements within the stipulated period will result in debts, with the possibility of facing penalties or inspections.

Property Taxes:

Taxpayers should regularise the taxes they record on their assets, as failure to declare them properly can lead to a notable accumulation of debts.

Fines and Penalties

Fines and penalties imposed by the AEAT for non-compliance with tax regulations are another significant type of debt.

These can be the result of:

- Failure to file returns on time.

- Failure to comply with formal requirements established by tax regulations.

- Irregularities in tax management that may be detected by the tax administration.

Administrative Fees

The Inland Revenue establishes fees that must be paid by taxpayers in various administrative situations.

Non-payment of these fees gives rise to debts, which may increase if they are not dealt with in a timely manner. The most common fees include:

- Fees related to the application for certain tax certificates.

- Fees related to the submission of certain administrative applications.

- Fees for the granting of specific licences or authorisations.

How to consult tax debts

Checking your debts with the tax authorities is a fundamental step in maintaining proper tax management.

Through the Tax Agency’s digital platform, it is possible to access updated information on outstanding tax obligations.

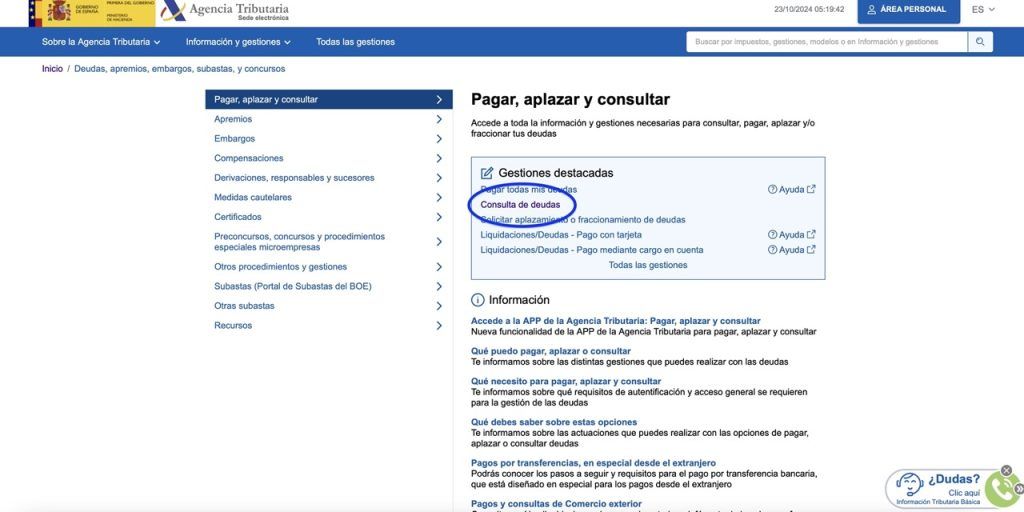

Access to the Tax Agency Portal

To start the consultation process, it is necessary to access the web portal of the State Tax Administration Agency (AEAT).

This portal offers an intuitive interface where taxpayers can consult their debt status.

It is important to have adequate access to make the query, as it helps to avoid problems in obtaining crucial information.

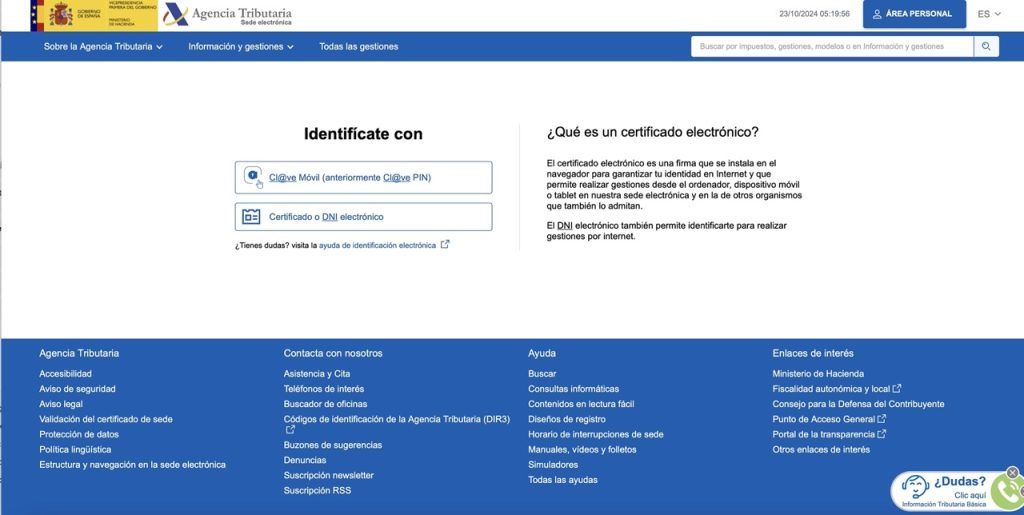

Use of Electronic Certificate

Access to debt information requires the use of an electronic certificate, which guarantees the user’s identity and provides secure access.

This certificate can be obtained through various accredited bodies or through the Spanish Mint (Fábrica Nacional de Moneda y Timbre).

Once installed, the certificate allows taxpayers to identify themselves electronically and access their tax data without inconvenience.

Available Consultation Options

The website of the Spanish tax agency has evolved a lot in recent years and now makes it much easier to consult and pay tax debts.

The AEAT offers several query options that allow taxpayers to check the status of their debts. These options include:

- Outstanding debts query: Display of current debts and their status.

- Details of each debt: Specific information about the nature of each obligation, corresponding period and other relevant data.

- History of debts: Access to the complete history of tax obligations, allowing exhaustive monitoring of the evolution of these debts over time.

Access to these options enables better financial planning by the taxpayer.

Keeping up to date on debts allows you to make informed decisions about payments and negotiations with the tax office.

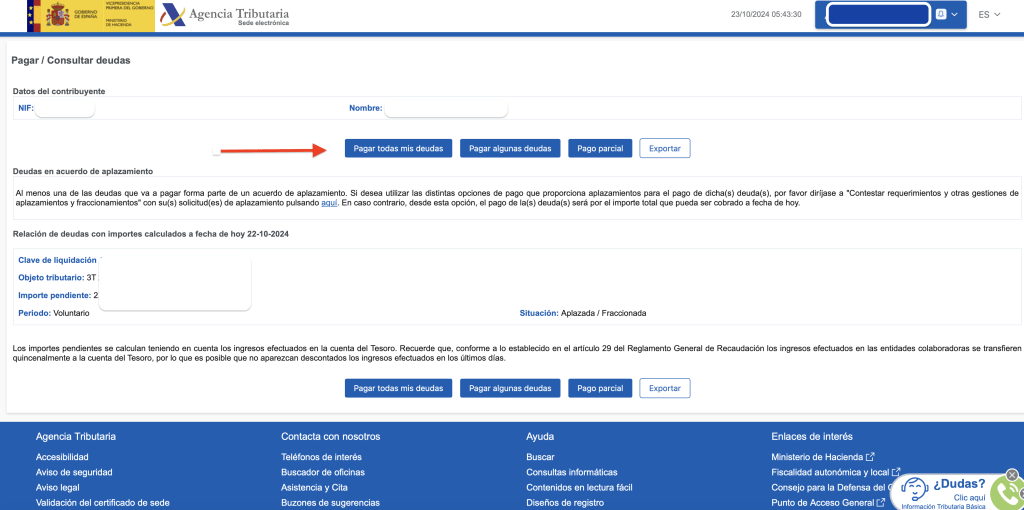

It is very important to look at the status of the debt.

This status can be:

In the voluntary lost period

Enforceable period

Deferred

Under embargo

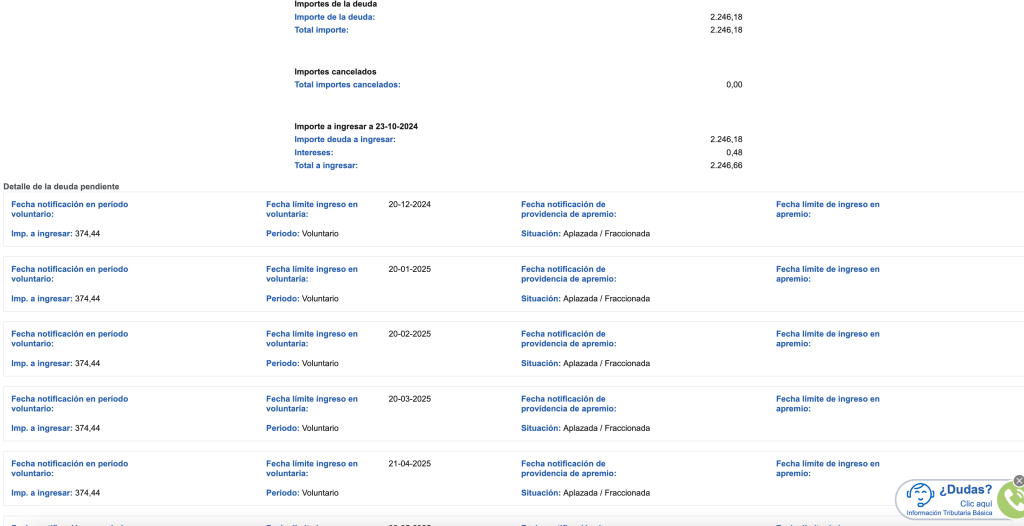

By clicking on settlement key you can consult the deferrals, date, amounts that will be debited from your account.

The tax authorities charge you on the 5th and 20th of each month.

Please note that even if you have paid the bill by direct debit for a deferral, it takes up to 15 days for the tax authorities to show it on the website. If this is the case, you will receive a notification stating that it has yet to be recorded.

Opciones de Pago para Deudas con Hacienda

Taxpayers facing debts with the Tax Agency have various alternatives for managing their payments.

These options make it possible to adapt the payment to the economic situation of each person or company.

Full or partial payment

One of the first decisions a taxpayer must make is whether to make a full payment of the debt or a partial payment.

This choice will depend on the taxpayer’s financial capacity and his or her strategy for settling the debt.

Payment in full:

This option allows you to settle the entire outstanding debt in one go. It is recommended for those who have sufficient resources to settle their tax obligation immediately.

Partial Payment:

Facilitates the payment of part of the debt. It is a useful alternative for those who cannot pay the full amount immediately, but wish to begin to regularise their situation.

Means of payment available

In order to take care of debts, the Inland Revenue provides different means of payment.

These options offer flexibility to taxpayers and are adapted to various needs.

Direct Debit

Direct debiting is one of the most common and simplest methods of paying tax debts and avoids long queues at the bank.

The taxpayer can authorise the AEAT to debit the amount due directly from their bank account, ensuring that payment is made in a timely manner.

Payment by card

Another option available is to pay by credit or debit card.

This alternative allows taxpayers to pay their debts quickly and securely through the AEAT’s online platform, as long as the operation is carried out during the opening hours of the entity.

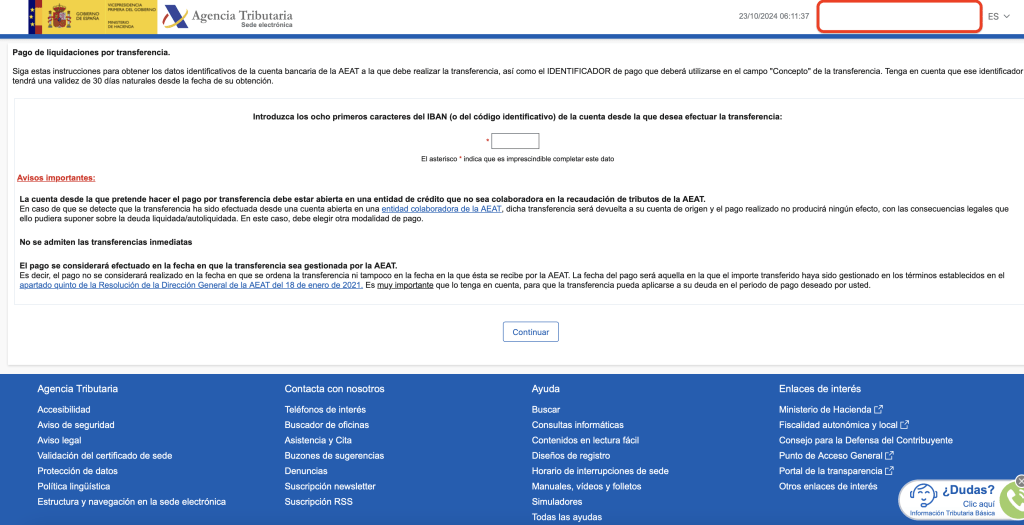

Bank transfer

Bank transfer is a versatile method that can be used especially for those taxpayers who are abroad.

This process requires the taxpayer to make a direct transfer to the account indicated by the tax office at the time of payment BUT you can only pay a debt by bank transfer if the account is not in the SEPA system or does not collaborate with the tax office.

Debt Deferment and Deferment in Instalments

For tax debts of up to 50,000 euros where the tax authorities grant the deferral automatically and no guarantees are required, the deferrals are now up to 24 months for individuals (previously 12 months) and up to 12 months for legal entities (previously 6 months).

For those taxpayers who cannot pay their tax debt in full immediately, the Inland Revenue offers deferment and instalment payment options.

These options make it possible to manage payment in a more flexible way depending on the debtor’s financial situation.

It is as if the tax authorities were granting a loan.

Procedure for requesting a deferral

The procedure for requesting a deferral of tax debts requires the taxpayer to submit a formal request. This process includes the following steps:

- Accessing the specific application form on the Tax Agency website.

- Fill in all the necessary data, including identification of the debtor and details of the debt.

- In some cases, submit additional documents justifying the request, such as economic reports or financial statements.

Once the request has been submitted, the AEAT will assess the taxpayer’s situation and decide whether or not to approve the deferral. It is important to bear in mind that each application is reviewed individually and the granting of the deferral is not guaranteed.

Terms and conditions for tax deferrals

The terms and conditions for debt deferral may vary depending on the amount of the debt and the reason for the request.

Generally, the issues to consider are:

Deadlines for Individuals

- Deferment periods may vary, but a maximum period of 24 months is common.

Terms for companies

- Deferral periods may vary, but a maximum period of 12 months is common.

- The AEAT requires that, for debts of more than €50,000, a guarantee or surety must be presented to support the deferred debt.

- Interest for late payment will be applied during the period of deferral, which will increase the total amount to be repaid.

Payment by instalments

Payment by instalments allows taxpayers to pay their debt in several instalments, thus facilitating the management of their tax burden.

This procedure has specific characteristics:

- The taxpayer must apply for instalments, indicating the number of instalments into which he/she wishes to divide the payment.

- The instalments are usually monthly and must be paid on the fixed dates to avoid additional penalties.

- Similar to deferral, payment by instalments may involve the payment of interest, which will be applied to the total amount of the debt.

Payment by instalments is a viable option for those who, although they intend to pay, cannot afford to pay the full amount of their tax liability at once.

Certificate of no debts

One of the biggest problems with tax debts is when you need a debt-free certificate to collect an invoice.

Unless the debt is deferred and in the voluntary period, you will not be given a debt certificate, i.e. you will not be able to collect.

Certificate of no tax debts

If on any occasion your company has to request a certificate stating that it has no tax debts (because it is required in order to subcontract work, to request a subsidy, to collect an invoice, etc…), remember that you can request it on the website http://www.aeat.es (section “tax certificates”).

Also , bear in mind:

- Even if you have any deferred or fractioned tax debt, the certificate must be equally positive (as your company is paying the debt within the deadlines granted by the Inland Revenue).

- However, in these cases, to avoid delays in obtaining the certificate, attach a copy of the receipt certifying payment of the last instalment of the deferment. Deferrals are paid by direct debit to the debtor’s account on the 5th or 20th of each month, and it takes 15 days for the tax authorities to receive proof of payment.

This may mean that, when you request the certificate, the tax office does not have the last payment on record and issues a negative certificate (or informs you that the issuing of the certificate requires a prior study).

Applying for a taxcertificate

After requesting the certificate, go to the section “reply to request, make allegations and/or provide document(s) associated with the application reference” and attach a copy of the latest receipt (indicating the reference number obtained when submitting the application).

Offsetting of tax debts

Sometimes your company has to pay tax debts when at the same time it has claims against the tax authorities.

For example:

- Those deriving from tax returns with a refund result or from requests for the refund of undue income.

- Those resulting from the enforcement of judgments or rulings in which the tax authorities have found in your favour.

- Those deriving from the reimbursement of the cost of guarantees provided to suspend appealed tax debts.

Offsetting of debts

These claims can be offset against the tax debts that you have to pay to the tax authorities.

However, before satisfying them, check whether you meet the requirements for such a set-off to be possible.

RECOGNISED CREDITS

Recognised

First of all, these credits must be recognised: in other words, there must be an express agreement from the tax authorities recognising your company’s right to a refund.

You cannot offset a refund that has not yet been agreed by the tax authorities.

In the event that this right derives from a final decision or judgement, the credit is understood to be recognised from the date of said decision or judgement.

In cases where it is necessary for the Tax Authorities to issue a tax refund, what happens if the Tax Authorities do not say anything?

Well, if the period of six months that the tax authorities have to issue the refund has elapsed, the credit in your favour will be automatically recognised.

In other words, from that moment onwards, the credit can be offset, even if the tax authorities take longer to expressly recognise it and issue the definitive payment order.

Request for offsetting

Once you have fulfilled the above requirement, you can then apply for offsetting.

In this way, if you wish to offset all or part of the 2024 Corporation Tax payment against the VAT refundable for the fourth quarter of that year (which is pending collection):

- When filing your Corporation Tax return via the AEAT website and choosing the method of payment, tick the option “Acknowledgement of debt with request for offsetting”.

- Then submit a letter through the Electronic Register referring to the return and request the offsetting.