Loan between individuals: how a mortgage works for a child or a friend

Patrick Gordinne Perez2024-12-06T06:50:44+00:00Loan between individuals or to a family member: if your child has a mortgage with the bank and you want to help them, lend them money to pay it back and take out a personal loan with them.

Interest-free loans between family members

Repayment of a mortgage or loan between private individuals

As you have funds that hardly give you any return, you have thought of lending this money to your son so that he can pay off his mortgage with the bank.

In this way, the debt will be owed to you, but with the advantage that no interest will accrue (in loans between individuals, a below-market interest rate or even no interest at all can be agreed).

Loans between private individuals

Personal loan between individuals

You can carry out this operation with a child or any other person you wish to help.

In any case, avoid tax costs by complying with the following formalities:

Sign a loan contract between private individuals

-privately or in front of a notary, indicating the applicable interest rate or no interest at all.

Present this loan

with form 600 at the ITP settlement office of your autonomous community and declare the loan between family members as exempt (loans enjoy this tax benefit).

Establish a calendar of annual repayments (e.g. a

(e.g. a constant instalment at the end of each year) and stick to it. Otherwise, the tax authorities may consider the transaction to be a gift and require your child to pay gift tax.

Loan between family members model 600

In order for the loan to be legal and not have any problems with the tax authorities, you will have to file form 600 with the tax authorities in your community.

The 600 form can be filed online but you will need a digital certificate.

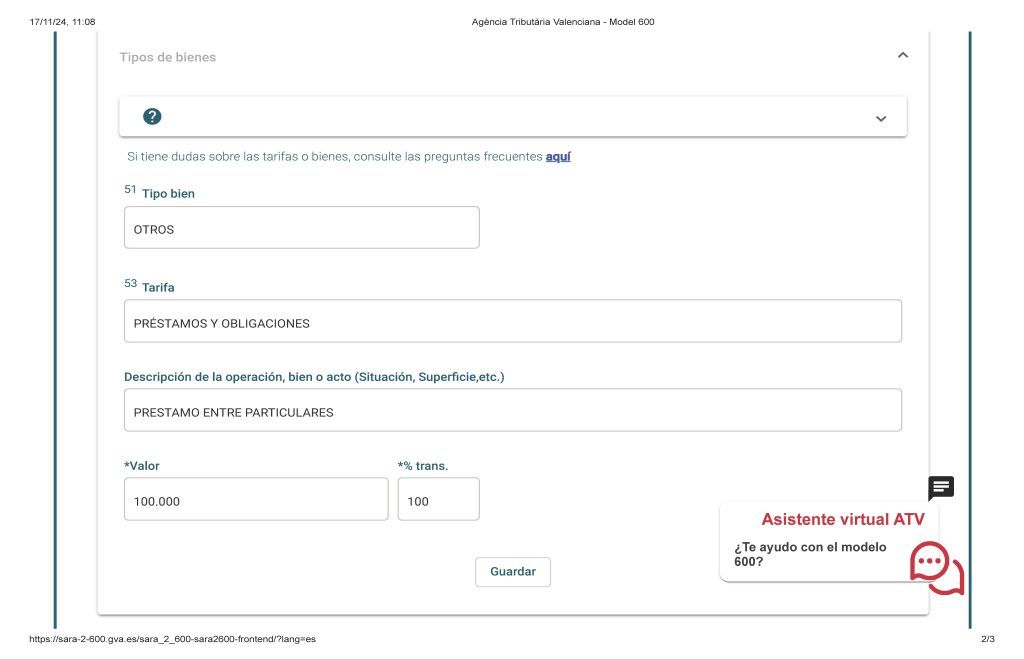

Example of form 600 for a loan between family members.

In this example from the Valencian Community of the form 600 for loans between individuals, we show you the important boxes to fill in:

- Date of accrual (Box 2): when the operation or loan is carried out. Here we have to put the date of the contract or when the money transfer was made.

- Concept (Box 4): It will be taxed for Transfer of Assets code 0001.

- Managing body: This is the city where the borrower’s settlement office is located (the one that receives the money). Normalement usually coincides with the city where you live or where your house is registered.

- Type of document ( Box 47). Here you have to indicate whether you have signed a private contract or a contract signed before a notary.

IMPORTANT

- Details of the type of asset (Box 51): In box 51 you must select 99 OTHER.

- Rate (Box 53) put that it is a loan between individuals and select PO0. ( EVEN IF YOU PUT 1% THEN PUT EXEMPT)

- VALUE You should enter the amount of the loan, how much money you are borrowing and a brief description of the transaction (e.g. “loan between family members”).

- On the next screen under Exemptions, allowances or not subject to activate the exemption tab and in box 73 of the exemption basis put 45.I.B.15 Loans .

- Click on calculate and you will get zero.

The next step is to enter the taxable person, the lender and file form 600.

Where do I file the form 600 for a loan between individuals?

You can file it in 2 ways:

- In person at the settlement office in your city.

- Or online:

These are the links to the different communities to file the form 600 online for a Loan between individuals:

Tips for the model interest-free loan agreement between family members

Model loan between private individuals

First, sign a written loan agreement.

This document should specify:

The purpose of the loan.

- Indicate the purpose of the loan (the purchase of the property, indicating the address).

Previously, this mention was relevant to justify that the payment of the loan generated the right to the deduction for the purchase of the main residence.

Although this deduction no longer exists, it should still be indicated so that the buyer can justify the origin of the money used to purchase the property.

Interest

- Also indicate that the loan is agreed interest-free, in view of the existing family relationship.

Repayment of the loan

In any case, it is not enough to sign the loan contract: the loan must be repaid.

Otherwise, the tax authorities may consider that you are actually concealing a gift and demand payment of the corresponding gift tax.

To avoid this risk:

- Comply with the repayment deadlines that have been agreed.

- Thus, if monthly repayments have been agreed, it is advisable to make these payments by bank transfer from the borrower’s account to the lender’s account, and to keep the receipts.

- In these transfers they should indicate as a concept the instalment being paid (e.g. “pago cuota enero préstamo”). Cash payments are not recommended (even if the lender signs a receipt).

Avoid Gift Tax

Establish repayment deadlines in the contract and, very importantly, stick to them, leaving a record of the payments (by means of a transfer, for example).

In this way you will avoid that in the future the tax authorities may consider that the loan was really a donation and demand the corresponding Donations Tax (ISD).

Proving the repayment of the loan between private individuals

It is not enough to simply justify the formalisation of the loan.

When the loan has been repaid in full, it is also important to go to the Settlement Office and prove this circumstance.

To do so:

- Sign a document in which the lender acknowledges having recovered the full amount of the principal loaned.

- Present this document at the Settlement Office, together with a copy of the bank receipts for the payments made.

- Together with the above documentation, the borrower must also present a form 600 declaring the transaction (in this case, as not subject to ITP).

Avoid tax requirements

As the tax authorities will already have the supporting documents, it will be more difficult for them to check them in the future.

Inheritance: what happens if the lender dies?

Please also note that, in the event of the lender’s death, any outstanding loans made by the lender will constitute credits in his favour which must be declared as part of his inheritance and will be taxed for Inheritance Tax purposes.

As the tax authorities are aware of the existence of these claims, if they are not included in the inheritance, they may initiate a check.

However, if a refund has already been credited, this will not happen.

Housing deduction

If your son bought your home before 2013, every year he will be applying a deduction in the IRPF for 15% of the amounts paid for the mortgage loan.

Well, if they act correctly, whether your child uses the loan you make to pay off the mortgage in full or only repays part of it, he or she can continue to benefit from this deduction for the amounts paid to you and, if applicable, also to the bank.

However, this requires a direct succession between the early cancellation (total or partial) of the mortgage loan and the formalisation of the new personal loan.

If there is no such direct succession (for example, if your child has other funds and repays the mortgage with them before taking out the loan with you), the tax authorities may consider them to be two separate transactions and prevent your child from benefiting from the deduction for this loan.

If the mortgage was taken out before 2013 and for the purchase of the main residence, your child will also be able to apply the home purchase deduction for the personal loan.