How to act upon receipt of a provisional tax settlement proposal?

Patrick Gordinne Perez2024-05-09T04:53:45+00:00What do we do if we receive a provisional tax settlement proposal from the tax authorities? Nobody likes to hear from the tax authorities, because most of the time when the tax authorities send us a letter, it is bad news. Sometimes very bad.

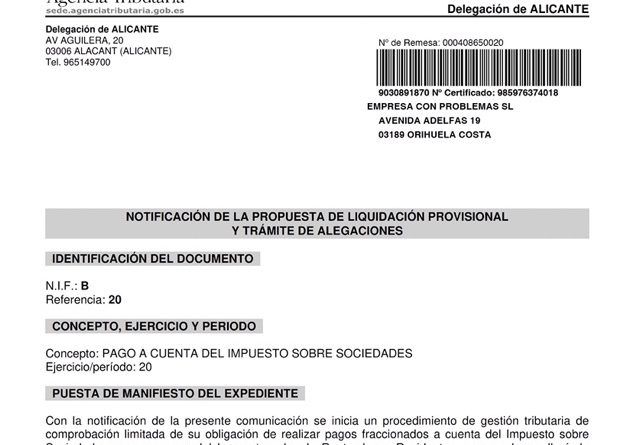

When the tax authorities consider that a self-assessment is incorrect, they send what is called a “provisional assessment proposal” (a “parallel”). In this article, written by people, not machines or AIs, we explain how to act after receiving a provisional assessment proposal.

What is a proposal for provisional tax settlement?

There is a discrepancy with the tax authorities

When the tax authorities consider that, on the basis of the information available to them, a self-assessment submitted is incorrect, they send a “provisional tax settlement proposal“, proposing an amendment to the self-assessment.

The result may be a higher amount to be paid than initially paid or a lower refund.

These proposals are known as “parallel”, as they usually contain a double-column sheet comparing the data entered by the taxpayer and those considered correct by the Tax Authorities, with an asterisk indicating the items where there are differences.

Provisional settlement proposals can be for any tax: provisional income tax settlement proposal, provisional VAT settlement proposal, corporate income tax settlement proposal, inheritance tax settlement proposal, transfer tax settlement proposal, etc.

The notification of the procedure for making allegations to the provisional tax assessment proposal is only a proposal.

If you or your company receive such a notification, remember that it is only a proposal: you still have time to present allegations and justify that your tax return was correct.

It will be later, once you have made your allegations and provided documents (or once the deadline has expired without having made any allegations), that the tax authorities will, if they continue in their determination, notify you of a tax assessment against which you will be able to appeal.

How to act after receiving a settlement proposal?

Motivation is sacred

Check that the communication received informs of the discrepancies found (the facts giving rise to the parallel) and explains the reason for the changes (the legal grounds).

This motivation is essential: without it, you will be defenceless (not knowing the reasons for which you are “accused”, it will be impossible for you to defend your interests).

If the tax authorities do not properly justify their proposal and finally confirm it, you will be able to appeal against the assessment and use this defect as an argument to have it annulled.

Submission of allegations and supporting documents to the AEAT

Even if it is a simple provisional tax assessment proposal, submit allegations to the AEAT and provide all the documentation and evidence you can gather to defend your interests. In the tax assessment proposal itself there is a form to make allegations to the tax assessment proposal.

You will not have to provide any guarantee or collateral to stop the collection (precisely because the liquidation does not yet exist, they send you a proposal), and you will get a double benefit:

- If your arguments are accepted, you will have avoided the final settlement (or you will have managed to get it modified in acceptable terms).

- If they are not accepted, you will be able to better assess whether or not it is in your interest to challenge the final assessment, and what type of appeal to make.

Requesting more time to present the AEAT allegations

If you anticipate that you will need more time to prepare the allegations or gather documentation and evidence, you can request an automatic extension of half the days of the deadline (so that, if the deadline for replying is ten days, it is extended to fifteen).

Accept the AEAT's provisional settlement proposal.

Provisional tax settlement proposal without arguments

In this case, the tax authorities will not have to study or assess your allegations and will send you the payment letters in the next few days. You agree to the provisional assessment proposal and tell the tax authorities that you agree to pay the debt.

There is no need for provisional clearance

In this case, the tax authorities have accepted your arguments and documents and you do not have to pay anything. Remember that the tax authorities must inform you that there is no need to make a provisional assessment.

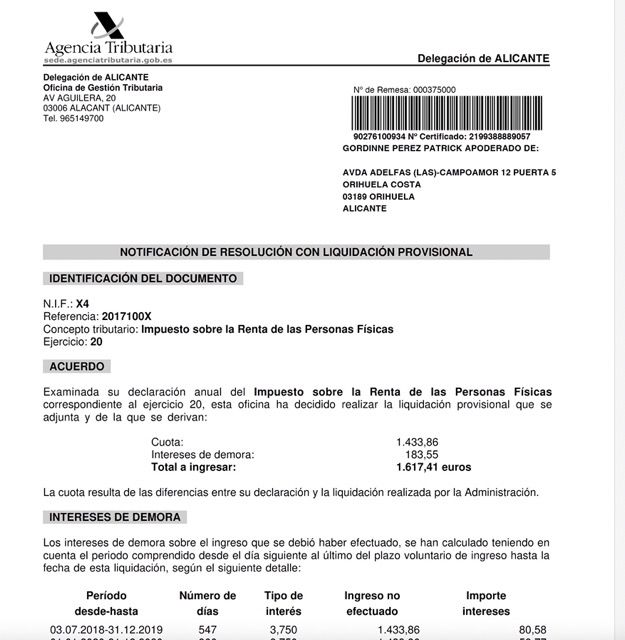

Receipt of provisional settlement

This one is more serious because the tax authorities have rejected our claims.

After submitting the allegations and documents (or not having done so), the tax authorities can continue to take the view that the situation should be regularised.

In this case, they will notify you of the corresponding “provisional liquidation” (which puts an end to the verification procedure) and will require you to pay the tax:

- To pay an additional tax liability to the one initially paid, together with the corresponding late payment interest.

- To repay part of a refund you have obtained, also with interest for late payment (if the tax authorities have already refunded it).

- Or reduce the amount of a refund you have applied for (if you have not yet been paid).

You have to pay yes..

Irrespective of any appeals, you are obliged to pay the tax liability as soon as you receive the tax assessment. The payment deadlines are as follows:

Very important: Deadlines for payment of the tax debt

- If you receive the tax assessment in the first fortnight of the month (15th day of the month inclusive), the deadline for payment is the 20th of the following month.

- If you receive it between the 16th and the last day of the month, the deadline for payment is the 5th day of the second subsequent month.

If the last day of payment is a Saturday, Sunday or public holiday, the payment deadline is extended to the next working day.

or not, request for deferment

Another alternative is to request, within the voluntary payment period, a deferment, assuming the late payment interest that may be generated. To do so:

- You must justify that your financial situation temporarily prevents you from making the payment within the voluntary period.

- If the total amount of debts deferred with the Tax Authorities exceeds 50,000 euros, you must provide a bank guarantee or other payment guarantees.

The payment of the debt or the request for deferral – with or without guarantees – does not imply that you agree with the assessment made by the Tax Authorities. Therefore, you may contest it in the terms set out below.

How to appeal against a provisional tax assessment?

You can file 2 types of appeals against the provisional settlement

If you decide to appeal against the settlement, you can lodge:

- An appeal for reconsideration to the Tax Authorities

- An economic-administrative claim before the Economic-Administrative Tribunal.

Deadline for lodging the appeal

In both cases, the deadline for lodging an appeal is one month from the day following the date of notification of the tax assessment.

The period ends on the day of the following month with the same ordinal number as the day on which the notification is received; and if this does not exist, the period ends on the last day of the month.

For example, if you were notified on 6 September, you can appeal until 6 October; and if you were notified on 31 March, you can appeal until 30 April.

Appeal for reconsideration (recurso de reposición in Spanish):

If you lodge an appeal with the Tax Authorities, it must be resolved by the same body that issued the provisional tax assessment (so if you have already submitted allegations to the initial proposal, it will be difficult for them to agree with you).

Administrative financial claim ( reclamación económico administrativa)

The other option is to file an economic-administrative claim against the tax assessment (either directly after receiving the tax assessment, or after your appeal for reconsideration has been rejected). In these cases, the Regional Economic-Administrative Court (Tribunal Económico-Administrativo Regional -TEAR- of your Autonomous Community.

Although this body is called a “tribunal”, it is an administrative body. Consequently, neither a lawyer nor a solicitor is required to file a claim.

If the TEAR does not agree with you either, you will be left with the ordinary courts. In this case, the assistance of a lawyer and solicitor will be necessary.

If the claim exceeds 150,000 euros (or 1,800,000 if a valuation or taxable base is disputed) and is rejected, before going to the ordinary courts it is necessary to lodge an appeal to the Central Economic-Administrative Tribunal (TEAC). In this case, it is possible to go first to the TEAR or directly to the TEAC.

Can I apply for a suspension of payment of a provisional tax settlement?

Yes, but you must expressly request the suspension and give guarantees of payment.

The lodging of appeals does not suspend collection (unless you are appealing against a penalty, in which case the simple lodging of an appeal does suspend collection).

Therefore, your company will still be obliged to pay the sums claimed as long as it does not expressly request the suspension.

To do so:

- You must provide Guarantees.

In general, you will need to provide guarantees (if you win the appeal, you can ask to be reimbursed for their cost – e.g. bank guarantee fees).

- No collateral.

You can suspend the payment of the provisional assessment without having to provide guarantees when the appeal is based on the existence of material, arithmetical or factual errors in the assessment.

The error must be obvious and manifest, without any legal interpretation being necessary to appreciate it.

Making a mistake in an addition or subtraction, putting an extra zero, changing one number for another or counting a negative item as a positive one would be material errors.

Errors of fact involve a misappraisal of the facts.

For example, imputing to a person a gain from a sale that he/she has not made, or not taking into account a disability granted by the Social Security.

And the errors must be clear and unquestionable, not arising from interpretations of the law (in which case they would be errors of law). And the tax authorities rarely make material, arithmetical or factual errors in the liquidation, or at least it is not very common to see errors of this type.

REMEMBER

Even if it is a provisional settlement proposal, submit allegations and documents proving that the data included in the self-assessment are correct.