Everything you need to know about form 130 for self-employed

Patrick Gordinne Perez2024-05-17T05:32:28+00:00What is the form 130 of a self-employed person?

Form 130 is a quarterly declaration

Individuals who carry out a self-employed activity in direct estimation (either normal or simplified) must submit a quarterly instalment payment (form 130) and declare the income from their activity.

These payments (on account of the personal income tax for the current year) must be submitted within the following deadlines:

- The payment relating to the first three quarters of the year, between the 1st and 20th of the months of April, July and October.

- The payment relating to the fourth quarter, between the 1st and 30th of January of the following year.

Form 130 is a cumulative declaration

These returns are cumulative. In this sense, in each quarter the income and expenses accumulated since the beginning of the financial year must be included.

Therefore, the net income that is declared in the fourth quarter is the same that will be included in the annual personal income tax return.

Remember that professionals who have most of their income subject to personal income tax withholding (either 15% or 7%, depending on the case) do not have to file form 130.

Specifically, this affects professionals where at least 70% of the income from their activity in the previous year was already subject to withholding.

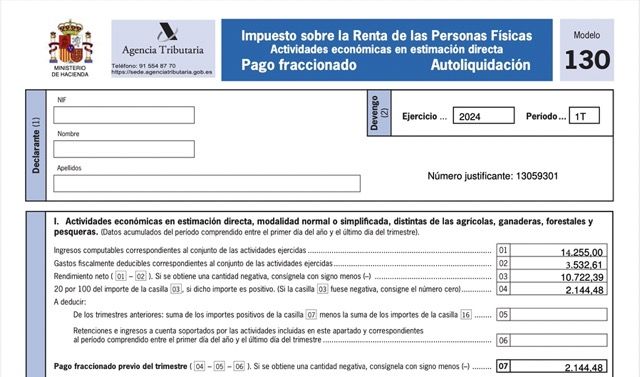

Calculation of form 130 of a self-employed person

Once you have determined the net income for each settlement period (from 1 January to the last day of the quarter), to calculate the amount to be paid in the payment on account, you must follow the following settlement scheme.

Rate of 20%.

First, calculate the full amount of the payment on account. To do this, you must apply a fixed tax rate of 20% on the amount of the accumulated net yield.

For this purpose:

- If the total tax liability thus calculated is positive, your client may deduct the following items.

- If it is negative, the amount to be entered is zero, and the tax return must also be filed as “Negative” and without making any disbursement.

Instalment payments and withholdings on form 130

From the positive amount thus calculated, your client will be able to deduct the withholdings that he has paid for the activity since the beginning of the financial year, as well as the other IRPF instalments made during the year (for example, in the October instalment payment, he will be able to deduct the instalments for the first and second quarter and the withholdings paid between 1 January and 30 September).

Self-employed persons can deduct withholdings derived from rented property for which they obtain income from economic activities (for which they must have at least one full-time worker), those paid in a professional activity, or those paid for image rights deriving from an economic activity.

Deduction for the Habitual Residence

After deducting withholdings and instalments, if your client purchased their main residence before 2013 and is entitled to the deduction for the purchase of a home in their personal income tax return, they can deduct an amount equal to 2% of the net income obtained from the first day of the financial year, with a maximum quarterly limit of 660.14 euros. To do so:

You must have acquired the home with external financing.

And you must have an annual total income (only total income, without deducting expenses) of less than 33,007.20 euros.

Given that you will not know your full income for the year until the end of the financial year, you will have to make a forecast based on the income from the activity in the first quarter, increasing the amount for the year.

In other words, if in the first quarter your client obtains income of 8,000 euros, the annual volume of income will be considered to be 32,000 euros, in which case you will be able to apply this deduction in your instalments.

In these cases it does not apply.

The 2% deduction is not applicable when two or more different activities are carried out for the purposes of calculating the fractioned payments (direct assessment, objective assessment or agricultural, livestock, forestry and fishing activities), or when the person concerned receives income from work and has informed the payer of the existence of the housing payments so that the payer can reduce the withholding rate to be applied.

Deductions for low income

Less than 12,000 euros

Finally, if the net income from economic activity in the previous year has been equal to or less than 12,000 euros, your client will be entitled to a quarterly deduction in the following terms:

| Net income for the previous year | Reduction |

| Equal to or less than 9,000 euros | 100 € |

| Between 9.000,01 and 10.000 euros | 75 € |

| Between 10.000,01 and 11.000 euros | 50 € |

| Between 11.000,01 and 12.000 euros | 25 € |

Calculation of form 130

For the purpose of calculating this deduction, please take into account:

If your client has started his activity in the same financial year, he may consider that the income from economic activities of the previous year is zero and, therefore, apply a deduction of 100 euros (as the income is less than 9,000 euros). Do not forget to apply this incentive (in the first year of activity, all aid is limited).

This deduction can be applied cumulatively each quarter. Thus, if the deduction of 100 euros is applicable, in the fourth quarter the total amount deducted will be 400 euros.

Each quarter the deduction calculated according to the table is applied (e.g. the 100 EUR indicated). However, when deducting instalments from previous quarters, the deduction applied in those quarters is not deducted.

And if in any quarter the instalments are not sufficient to absorb the deduction, the excess is not lost and is deducted in the following quarter.

Example:

See the instalment payments to be made in the case of an entrepreneur who last year had a net income from his activity of only 8,000 euros (to simplify the calculation, we consider that he does not benefit from a deduction for the purchase of a main residence and does not have to pay withholdings):

| Concept | 1Q | 2Q | 3Q | 4Q |

| Accumulated income | 3.000 | 8.000 | 12.000 | 18.000 |

| Cuota 20% | 600 | 1.600 | 2.400 | 3.600 |

| Payments to previous account (1) | – | -600 | -1.600 | -2.400 |

| Deduction (2) | -100 | -100 | -100 | -100 |

| To enter (3) | 500 | 900 | 700 | 1.100 |

Payments on account from previous quarters that would have been paid if the low income deduction had not been applied.

As in the previous year the net income was less than 9,000 euros, the quarterly deduction is 100 euros.

The amount paid over the whole year is 3,200 euros (3,600 euros minus the 400 euros deduction).

Final result of form 130

If Form 130 is negative

If, after deducting withholdings, fractioned payments and deductions from the total tax liability, the final result is negative, your client must also file form 130, but without paying any amount and expressly stating that the return is “Negative”.

When calculating the amount of each instalment payment, deduct the withholdings borne and the instalments made.

And do not forget to also apply the deduction for the purchase of a home and for obtaining low income.

Civil companies no longer file form 130 (since 2016) but instead file the corporate income tax IS.

It is the civil partnership that pays tax on the income from the activity. The partners must do so only for the amounts they receive, which are subject to withholding.

If you are the owner of a civil partnership that is going to pay corporate income tax, remember that you no longer have to submit payments on account of the IRPF…

Cessation of activity and form 130 for self-employed

Census declaration

You are self-employed and pay personal income tax under the direct assessment system. Well, if you cease your activity, you must inform the tax authorities first. Note.

To do this, you must file a census declaration within one month of the date you cease to be self-employed. From that moment on, you will no longer have to submit payments on account of personal income tax (form 130).

Subsequent collections and receipts

However, it is possible that you may subsequently receive some payment for sales made before the termination or receive other income from the business such as compensation (e.g. for stock claims) or gains from the sale of business assets.

How are they taxed on form 130?

Receipt of these post-termination receipts and payments will not oblige you to submit new payments on account.

However, when you file your IRPF, you will have to declare all this income as income from economic activities.

Sale of assets

There is one exception to the above rule. In the case of the sale of fixed assets assigned to the activity, the income obtained must be declared as capital gains or losses in the savings base.

The same applies when the activity is in operation and has not yet ceased.

Income from the activity obtained after the cessation of the activity does not require payment on account, but, in general, it is declared in Personal Income Tax as income from economic activities.