All you need to know regarding summary invoices

Patrick Gordinne Perez2024-02-10T18:15:20+00:00Many businesses generate many small invoices regularly, which can mean extra accounting work to manage them all. A recapitulative, grouped, or summary invoice is an ideal tool for this type of business, as it allows you to simplify the task by grouping several invoices into a single document.

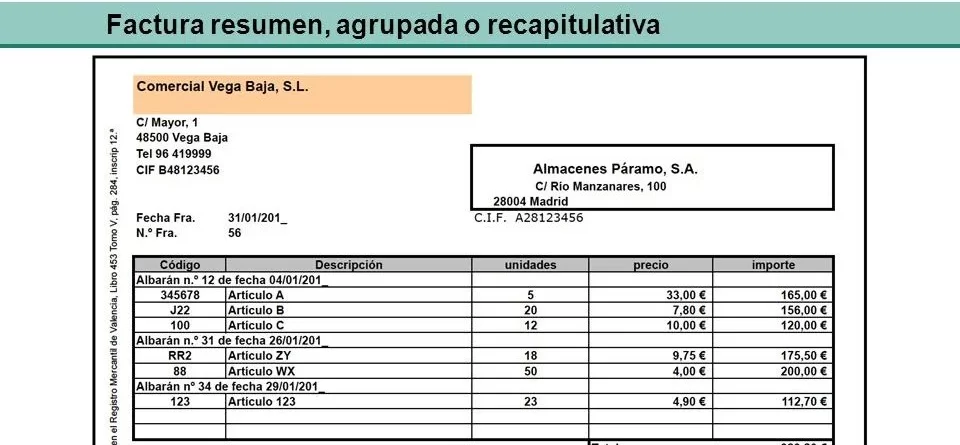

What is a summary invoice?

A summary invoice is an invoice that groups together several invoices for purchase or sales transactions with the same issuer or recipient in the same calendar month. It is an invoice that combines all the transactions a company has carried out with a customer or supplier and is used to post grouped invoices.

For example, suppose we have issued several invoices to a customer in one month. In that case, we can make a summary invoice that gathers all the information of the invoices issued during that period of time. In this way, we save the process of issuing invoices to our customers one by one, and we can deliver a single invoice that collects all the other invoices,

What is the purpose of a summary invoice?

A summary invoice is a handy tool for companies that need to account for many purchase or sale operations simultaneously, which allows them to speed up accounting and reduce efforts in this regard.

For example, let’s say a freelancer sells massage sessions and has ten clients who each buy ten sessions per month. Instead of issuing 100 separate invoices (one for each session), he could issue one recapitulative invoice for each client covering all ten sessions. This saves us the process of issuing invoices to our clients one by one, and we can give them a single invoice covering all the other invoices, which will speed up our invoicing.

General requirements for summary invoices

Several requirements or conditions must be met for a summary invoice to be legally and financially valid.

- A summary invoice must cover multiple purchases or sales within a calendar month.

- Invoices in a summary invoice must be issued to the same customer or received from the same supplier.

- Grouped invoices must be for transactions within a calendar month. In other words, combining invoices from different calendar months in a consolidated invoice is impossible.

- Aggregated invoices must be issued to end-users carrying out activities no later than the last day of the month. If the recipient is self-employed or a company, this deadline is changed to the 16th of the following month.

- In addition, all invoices included in the total invoice must be cancelled to be valid. The previous invoice must be added to the statement invoice so the amount can be posted. It is essential to clarify that even if the attached invoices are “cancelled”, they must be retained for the next 5 years as they may be requested by the tax office.

What are the mandatory details on the summary invoice?

- A summary invoice, like any other invoice, must contain a series of mandatory data specified in the invoicing regulations to be legally and commercially valid.

- A summary invoice contains the same mandatory data as a general invoice, but with some details, which we will discuss below. The following are the mandatory data to be included in the summary invoice:

- The text “summary invoice” as a visual indication in the title.

Any invoice number with an associated serial number.

date of issue. It is also necessary to indicate the calendar month of the declaration operation on the declaration invoice. – Financial data of the issuer and recipient. - Invoice row. Like the item rows in a free text invoice, a summary invoice will have a row for each invoice charged. We tell you more about these rows in the next section.

- Common tax base. That is, the sum of all the tax bases for a summary invoice.

- Taxes and deductions at source.

- That is, the corresponding VAT and the applicable personal income tax withholding.

- The total amount of the invoice.

What date should be on the recapitulative invoices?

Recapitulative invoices are normally drawn up at the end of the calendar month in which the operations to be grouped together occurred. Thus, the date of a recapitulative invoice may be the date of the last operation or the last day of the month.

However, in the case of recapitulative invoices sent to professionals or companies, it is possible to issue it after the calendar month, as long as it is done before the 16th of the following month.

Remember that recapitulative invoices must also indicate the calendar month of the recapitulated operations.

Is it possible to issue recapitulative invoices for simplified invoices?

Yes, it is possible. To group several work orders (also known as simplified invoices) in a summary invoice, the procedure is the same as for creating an invoice grouping several free text invoices. However, summary invoices can only be issued if the total amount of the invoice, in which the notes are grouped together, does not exceed 3,000 euros.

If you have any questions, please do not hesitate to contact us.