5 conditions for you to be able to deduct the deductible VAT

Patrick Gordinne Perez2024-02-14T16:25:10+00:00In this post we give you the keys to make VAT tax deductible and we tell you the five conditions for self-employed and companies to be able to deduct DEDUCTIBLE VAT from their expenses on their invoices

Every year, the spanish HMRC or agencia tributaria AEAT (the Tax Agency in Spanish) makes thousands of requests to companies and freelancers to check their quarterly VAT returns. Many of them end up with a parallel liquidation and a penalty for the amount that has not been paid. According to the experts consulted, most of the penalties imposed by the Treasury are due precisely to having tried to deduct more expenses than the taxpayer is entitled to or to having failed to comply with some of the basic requirements for deductions in this tax.

Background information on deductible or input VAT

The deductibility of VAT expenses is one of the oldest fights and the one that has caused the most problems for the self-employed and entrepreneurs with the tax authorities because in the end it is a matter in which the criteria and/or interpretation of the regulation of the civil servant is involved.

As the self-employed and entrepreneurs website say, unlike the Personal Income Tax law, which does include a detailed list of deductible expenses, the VAT regulations are much more confusing and only specify what is not deductible, such as jewellery, tobacco, donations or gifts and other personal expenses. Furthermore, Article 95 of VAT Law 37/92 states in point one that “entrepreneurs or professionals may not deduct the VAT paid or paid for the acquisition or importation of goods or services that do not directly and exclusively affect their business activity or profession“. Directly and exclusively, that is the crux of the matter.

From this point on, the self-employed entrepreneur or the consultancy firm must determine, depending on their activity, which expenses are deductible and which are not, always knowing the red lines such as, for example, the deduction of vehicle expenses – which for most self-employed workers VAT is deductible at a maximum of 50% – (remember that in Personal Income Tax vehicle expenses are not deductible – except in certain cases – because it is practically impossible to differentiate between professional and private use of the vehicle), fuel or certain gifts to clients and suppliers. However, beyond the specific expenses, the Tax Agency has established five general criteria on its website, basic requirements that any expense must meet in order to be deductible for VAT purposes.

Five general requirements for the VAT on an expense to be deductible

According to the Tax Agency’s website, the following requirements must be met in order to be able to deduct input VAT payments:

- You must be a business or professional for VAT purposes. This is the most basic requirement. In order to be able to deduct a VAT expense, you must be self-employed or a businessperson for VAT purposes, i.e. have an economic activity, as private individuals do not file VAT returns and are not entitled to deduct expenses.

- Carrying out transactions that give the right to deduct. In order to be able to deduct VAT on an expense, logically, the activity carried out by the self-employed person must be subject to the tax. Therefore, certain activities that are not subject to VAT, such as healthcare, education, certain real estate transactions or social welfare, will not be eligible for deductions.

- The expenses paid must relate to goods or services which are used exclusively for the business or professional activity and necessary to get the incomes. In other words, the goods or services you pay for must be directly related to the economic activity of your business. This would be one of the most problematic aspects of VAT deductions. At the moment it is not clear which expenses are and which are not deductible for which business. What is deductible for a plumber, such as his tools, would probably not be deductible for a hotelier or a trader. Everything is at the discretion of the tax official. In addition, there are expenses such as vehicle expenses for which the tax authorities usually question the link to the professional activity for almost all activities, with the exception of a few, such as taxi drivers or hauliers.

- The invoice or document justifying the right to deduction must be in possession, which must comply with the regulatory requirements and be recorded in the register of invoices received. This is another of the conditions that may cause problems for the self-employed with regard to the tax authorities. If an invoice is lost and is not provided to the Tax Agency in a summons, or if an invalid document -such as a simplified invoice- is provided, it is possible that the Tax Agency will liquidate that amount and impose a penalty on the self-employed.

- Once this has been done, the right to the deduction can be exercised in the corresponding declaration-settlement, provided that this does not exceed the period of four years following the moment of accrual of the VAT payments. It should be borne in mind that the deduction of an expense should normally be applied in the tax return for the quarter in which it was incurred. If the deadline has passed, the self-employed person has up to four years to provide it, but experts warn that the longer the time elapses since the expense was incurred, the more likely it is that the tax authorities will require the self-employed person to justify the expense.

What data does an invoice have to include to be VAT tax deductible and how does it have to be accounted for?

An invoice is a very important document that records the commercial transaction between a supplier and a customer.

According to the AEAT or Tax Agency, for an expense to be fiscally deductible it must comply with the provisions of article 106.4 of the General Tax Law, which states that when it comes to accrediting deductible VAT and the deductions that are made, when they originate from operations carried out by businessmen or professionals, they must be justified, as a priority, by means of the invoice of the businessman or professional who has carried out the corresponding operation. This invoice must also comply with the following requirements set out in the tax regulations.

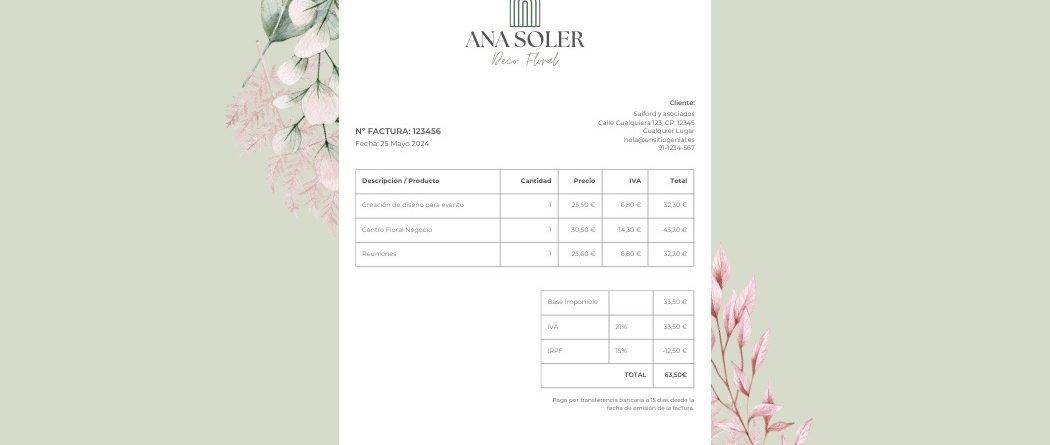

This means that, first of all, for an expense to be deductible, the invoice justifying it must be correctly drawn up. According to the invoicing regulations, in order for an invoice to meet the requirements of the tax regulations and, therefore, serve as proof of a deductible expense, it must contain at least the following information:

What information must an invoice contain by law?

- Invoice number and, where applicable, the serial number. The numbering of the invoices within each series will be correlative.

- The date of issue of the invoice.

- Name and surname, or full company name of the company, both of the person obliged to issue the invoice (company or self-employed) and of the recipient of the operations (the client).

- Tax Identification Number (NIF), remember that for individuals the DNI or NIE is their VAT number or the NIF attributed by the Spanish Tax Administration in the case of a company or, where applicable, by that of another Member State of the European Union, with which the person obliged to issue the invoice has carried out the transaction.

- Address, both of the person obliged to issue the invoice and of the client or recipient of the transactions.

- Description of the operations or concept, including all the data necessary to determine the taxable base of the tax. The unit price excluding tax for these operations must also be included, as well as any discount or rebate that is not included in this unit price.

- The tax rate or percentage applied to the transactions.

- The tax liability or deductible VAT which, where applicable, is charged, which must be entered separately (this will be the amount of deductible VAT for the self-employed or entrepreneur who bears the VAT).

- The date on which the transactions being documented were carried out or on which, where applicable, the advance payment was received, provided that this is a date other than the date on which the invoice was issued. Remember, if you receive an advance payment, you must issue an invoice.

- In the event that either party is on a special system (e.g. cash basis), you should mention this on the invoice.

Books Accounting records where all transactions subject to VAT must be reflected in order to be deductible.

In addition, in order for VAT to be deductible, the expense must be duly accounted for and recorded in the VAT registers. According to the Tax Agency, entrepreneurs or professionals, who are liable for VAT, must account for and record all their transactions within the deadlines established for the monthly or quarterly settlement and payment of the tax. The accounts must be able to accurately determine both the total amount of VAT charged to their customers and the total amount of input tax or deductible VAT on the purchase of goods and services from their suppliers.

The VAT registers are as follows:

- Register of invoices issued.

- Register of invoices received.

- Register of investment goods.

- Register of intra-Community transactions.

The record books may be kept by electronic or computerised means, in which case, the files, databases and programmes necessary to allow full access to them must be kept during the limitation period, which is 4 years after the deadline for filing the corresponding return.

In the case of entrepreneurs who are registered in the REDEME (monthly return register) with a monthly VAT self-assessment filing period, the VAT registration books must be filed through the AEAT’s Electronic Headquarters, by means of the electronic supply of invoicing records (SII, immediate information system).