WHAT IS CROWDFUNDING AND HOW IS IT TAXED?

Patrick Gordinne Perez2024-03-27T09:16:20+00:00Today any entrepreneur knows the difficulty of borrowing money from the bank, not having debts, being a good payer, having to balance the numbers, the personal guarantee of the partners, start-up costs, hell. But there are other ways of financing and here we explain how to finance a business project and through a ‘Crowdfunding’ platform.

What is Crowdfunding?

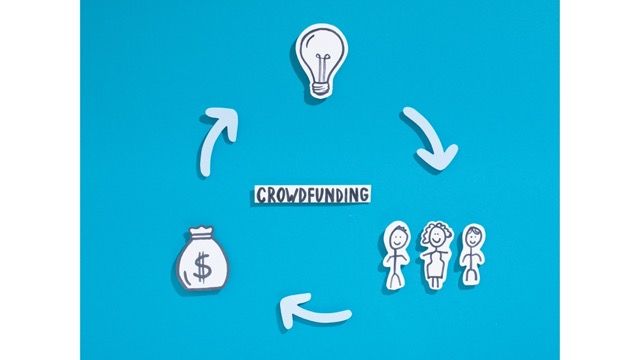

Crowdfunding (or participatory financing) is a formula used to bring together entrepreneurs (SMEs and start-ups) who need funding for their projects with potential investors interested in financing these projects in exchange for a consideration.

Investment can take various forms:

- By granting a loan. In this case, the consideration will be the repayment of the capital loaned plus interest.

- By acquiring shares or stakes in the company. In this way, the investor becomes a partner and, in due course, will participate in the company’s profits.

How does Crowdfunding work?

- First, the entrepreneur (project promoter) sends his or her proposal or business idea to a crowdfunding platform (by typing “crowdfunding platform” into the Google search engine, you will find different options).

- The platform then studies the proposal and decides whether to publish and promote it for a certain period of time.

- Finally, potential investors evaluate the different projects and, if they are interested, provide funds.

If the stipulated amount is not raised within the stipulated period, the platform refunds the investors’ contributions.

Advantages of Crowdfunding

The truth is that crowdfunding is all about advantages but you have to have an interesting and solid idea or project to attract investors.

It is negotiable

Crowdfunding offers the possibility for the promoter and the investor to negotiate the financing to be lent depending on the form it takes (via loans or via the acquisition of negotiable securities).

On the other hand, you have little negotiating leverage with a bank (especially if you are just starting out and do not have the backing of a solid business track record), so you generally have to accept the conditions imposed by the bank.

Crowdfunding It is cheap

The project promoter who receives the loan financing would only be obliged to repay the investor the amount received plus the agreed interest.

Therefore, the arrangement fees and the fees for non-disposal or early cancellation that are usually applied by banks disappear.

It is agile and secure

The entire process is carried out through the online platform in a convenient and efficient way, without the bureaucracy and formalities of bank financing.

Furthermore, with the new regulation, these operations will be more secure, as a legal framework has been established with the corresponding means of complaint in the event of non-compliance and its sanctioning procedure.

There are currently various types of Crowdfunding (or crowdfunding). See below how each of them is taxed.

Crowdfunding investment

A first alternative is “investment crowdfunding” (or equity crowdfunding), which is reserved for companies (SA and SL).

Here, investors raised through the crowdfunding platform acquire shares in the company.

This alternative can be very beneficial for investors, since, if the company has been incorporated in the last three years, their contributions can enjoy a deduction in the IRPF of 20%.

(The maximum annual investment per investor eligible for deduction is 50,000 euros).

Loan Crowdfunding

Another common alternative is “Crowdfunding lending” (or Crowdlending), whereby the investment platform attracts investors who make loans to the company in exchange for interest.

As with other loans, the interest paid by the company is a deductible expense for the company, and the partners must pay tax on it in their personal income tax, including it in the savings base.

Crowdfunding with Reward

Transaction with VAT.

Another financing option is “Crowdfunding with reward”.

Through this method, the investor makes a cash contribution and, in exchange, the company undertakes to deliver a good or a service (generally the products or services it will market).

In these cases, the delivery in cash is considered an advance payment for these operations, so the company must issue an invoice and charge the corresponding VAT and pay it to the tax authorities.

Deposit.

On the other hand, the company must compute the corresponding income and pay the corresponding tax on it for Corporate Income Tax (or Personal Income Tax in the case of an individual entrepreneur).

However, if it is agreed that the delivery or service will be made after a certain period of time, the amount received may be counted as an advance payment from customers and computed as income at the time the delivery or service is made.

No Reward

Donation.

The last modality is “Crowfunding without reward”, in which the company receives donations for its activity. This type of crowdfunding can occur in companies that, despite having a profit-making purpose, carry out an activity that benefits society or the environment (for example, a company that researches into clean energy).

In these cases:

- If the recipient of the donation is a company, it must declare a higher income and be taxed on it in its corporate income tax.

- If it is an individual entrepreneur, the amount received is a donation and must be taxed under the Donations Tax (ISD).

Excess donation.

This ISD taxation is also payable if the investors receive a good or service of a lower value than their contribution.

This would be the case, for example, of an entrepreneur who intends to obtain contributions of 20 euros for his project in exchange for handing over a bracelet valued at 5 euros: he must declare a donation of 15 euros.

Each type of crowdfunding is taxed differently. Thus, in the case of Crowdfunding with reward, the company must charge VAT on the value of the goods it delivers in exchange for the contributions received.