Easy vat calculator: Useful Tools and Tips

Patrick Gordinne Perez2024-06-14T03:51:41+00:00If you are an entrepreneur, trader or just want to learn more about how to calculate VAT correctly, you are in the right place. In this article, we will explore the importance of calculating VAT accurately and introduce you to the best VAT calculator for your needs.

We’ll also give you some practical tips on how to use this tool efficiently – read on to find out more!

Discover the best VAT calculator for your needs

When it comes to calculating VAT accurately, it is essential to have an efficient VAT calculator that suits your needs.

Discovering the best VAT calculator can make all the difference to our ability to make quick and accurate calculations.

VAT Calculator knowing the final price

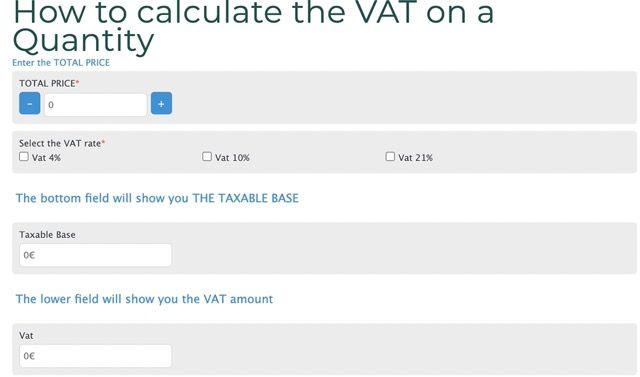

If you know the final price and want to know the VAT at 21% 10% or 4% of that amount, enter the total price.

By simply entering the total price , our vat calculator will automatically provide you with the value of the VAT you pay and the taxable amount.

VAT tax Calculator

If you know the taxable amount and you want to know the VAT at 21%, 10% or 4%.

By simply entering the taxable amount, our vat calculator will automatically provide you with the value of the VAT you pay and the Final Price.

Did you know that with Asesoria Orihuela Costa you have a free invoicing program?

In this article we have explored a number of accurate VAT calculators. You will be able to calculate the VAT on an invoice correctly and avoid possible mistakes. Quickly and accurately

If you are looking for a simple and accurate way to calculate VAT, our specialised VAT calculator is the perfect tool for you.

You no longer have to worry about complicated calculations or making mistakes when determining the tax.

If you want to dig deeper here is our guide on how to calculate VAT on an invoice.

Practical tips on how to use the VAT calculator efficiently

When using a VAT calculator, it is important to follow some practical tips to make efficient use of it.

First of all, make sure that you enter the values for the price excluding VAT and the applicable VAT percentage correctly. A small error in these data can lead to incorrect results.

Also, check that you are using the right formula for the VAT calculation, as there are different methods depending on the country or region.

It is also advisable to use a reliable and up-to-date calculator, preferably one that allows reverse calculations, i.e. calculating the price excluding VAT from the price including VAT.

By following these tips, you will be able to use the VAT calculator efficiently and get accurate results in your calculations.

Doubts about VAT?

The AEAT has a free virtual assistance service, with tools that can help you resolve certain VAT doubts.

See some of them:

- SII virtual assistant, for doubts related to the Immediate Supply of Information.

- Localisation tool, to determine how an international supply of goods or services is taxed.

- Real estate qualifier, to determine how property purchase and sale or lease transactions are taxed.

- Help in preparing form 303, for lessors of urban premises and dwellings who do not carry out any other activity.

- Deadline calculator, to rectify invoices for unpaid invoices or to rectify VAT deductions.

Census doubts.

In addition, a new tool has recently been launched called “Economic activity finder“, which indicates the headings of the Economic Activities Tax – and, where applicable, the equivalent activity code (CNAE) – that are applicable to an economic activity.