Guide on how to calculate vat on an invoice

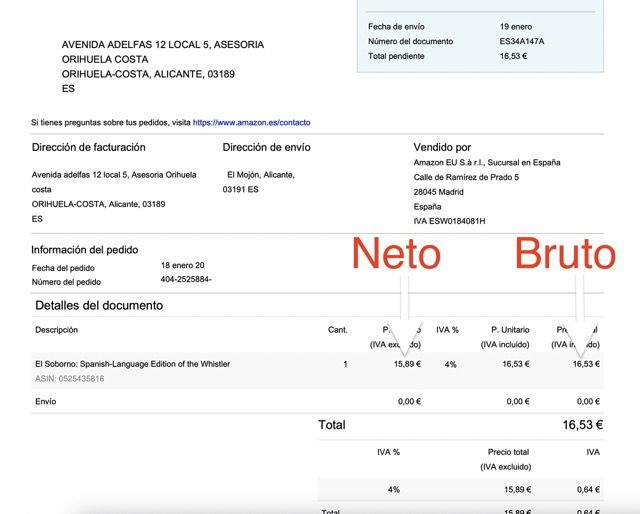

Patrick Gordinne Perez2024-02-26T17:08:36+00:00To calculate the vat on an invoice it is essential to know that vat is calculated on the taxable base of the invoice and not on the total. Most companies and freelancers know what is the net and gross of an invoice but if you have never made an invoice and have never worked with vat it can be a bit difficult.

What is the taxable amount of an invoice?

The taxable amount is the value of the goods excluding tax and the sum of all the values of the goods on an invoice is the taxable amount of the invoice.

In other words, it is the value that the businessman pays for the product he sells, plus the costs of transport and manufacture or transformation plus the profit he deems appropriate.

If you go to a supermarket and see a price of €5.43 for yoghurts, what would be the taxable amount?

There are two things to know (one easy and one a bit more difficult)

To know the VAT rate on the product, in our case 10% (did you know?). Here you have a link to know the VAT rate of all the things that are sold in Spain.

Divide by 1,1 ( 1 plus the vat percentage, 0,10€ in our example).

How to calculate the vat on a total amount?

How to calculate the vat 10 %?

To calculate the vat on a total amount you have to do the following operation:

5,43

—= 4,94

1,1

So 4.94 would be our taxable base. To calculate the vat of 4.94 it is as simple as multiplying the base by the vat percentage. In this case 10%.

The vat rate of 10% is 10/100= 0,1

4,94 x 0,1 = 0,49

4,94 + 0,49 = 5,43 which is our final price.

Calculate vat 21 %.

Remember that it is always rounded to two figures.

Remember if you know the taxable base and you want to calculate the vat you have to multiply by the vat percentage.

If you have the final price (vat included) you have to divide by 1 + the vat percentage.

To calculate the total vat you have to divide the total amount by 1 + plus the percentage, in our case:

242

—– = 200 taxable base

1,21

The formula for calculating the vat taxable base would be :

X

——

1 + %

How to calculate the quarterly vat in the quarterly 303 declaration?

It is very easy, you have to make a list of all the invoices of this type.

VAT charged or VAT collected

Total vat taxable base

1.000 210 1.210

500 105 605

———————-

1.500 315 1.815

VAT paid or input tax paid

100 21 121

50 10,5 60,50

———————-

150 31,50 181,50

The calculation of the vat payable would be :

315 – 31,50 = 283,50

Let’s look at a practical example of how to calculate vat

Postal invoices do not break down the vat.

The invoice does not include VAT

After doing some paperwork at the post office and asking for the corresponding invoice, you notice that the VAT is not broken down on the invoice.

Instead, you see a text stating that … the VAT included in this invoice amounts to 8.23% of the total price stated….

In order to be able to deduct VAT from an invoice, the invoice must show the tax base and the amount of VAT.

However, in this case, the tax authorities have authorised the post office to issue invoices as indicated (i.e. without itemisation), so you will still be able to deduct the VAT indicated (which is calculated by the post office according to its percentages of VAT exempt and non-exempt transactions).

Example of how to know the vat on a postal invoice

However, you will have to calculate the deductible VAT yourself. If, for example, the invoice amounts to 15.26 euros and the deductible VAT percentage indicated to you is 8.23%, the breakdown will be as follows:

Concept | Euros |

Tax Base : 15,26 / (1 + 8,23%) | 14,10 |

Cuota (15,26 – 14,10) | 1,16 |

Total invoice | 15,26 |

For postal invoices, you will have to calculate the deductible VAT yourself, according to the percentage indicated to you.

Did you know that Asesoria Orihuela Costa provides you with a free invoicing software that automatically calculates quarterly VAT?

En ocasiones, su empresa entrega de manera gratuita productos a sus trabajadores, o se los ofrece con importantes descuentos. ¿Qué debe tener en cuenta en estos casos respecto al IVA?

What about VAT on gifts to employees?

The provision of goods free of charge to workers by the company is called “autoconsumo de bienes”.

In such cases, even if the company does not collect any VAT on these supplies, it must pay the VAT applicable to these transfers to the tax authorities.

For this purpose, it must issue an invoice in the name of the beneficiaries and include the tax.

How to calculate the VAT on the self-consumption of goods?

The taxable amount on which VAT must be calculated is as follows:

- If the goods supplied have been used in the activity (e.g. computers that have become obsolete), the taxable amount will be the value at the time of supply. For this purpose, value them at their net book value if they are not fully depreciated, and at their approximate market value if they are fully depreciated.

- If they are products manufactured or marketed by your company (e.g. a shoe shop that gives away shoes to its employees), the taxable amount will be the acquisition cost.

What is the acquisition cost of the good?

The acquisition cost will be the purchase price (if your business simply markets the goods), or the production cost (if your business manufactures them).

If the goods have deteriorated (because they have been badly stored, damaged, etc.) and their actual value has fallen below their acquisition cost, you can calculate VAT on the basis of the actual value (i.e. after deterioration).

Do you have problems calculating vat? Contact us