Taxation of vehicles for corporate income tax purpose

Patrick Gordinne Perez2024-02-16T06:49:21+00:00La tributación de los vehículos en el Impuesto de Sociedades

The taxation of vehicles for corporate income tax purposes has specific characteristics. Do you want to know them and need help? This article gives you the keys.

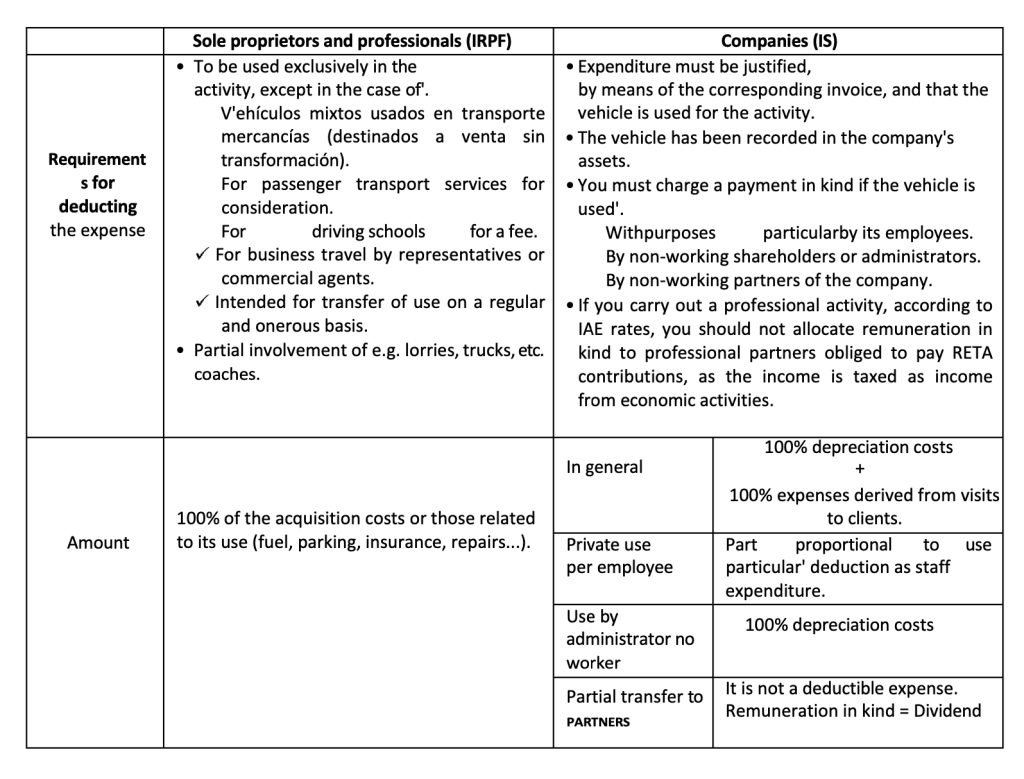

Company vehicles are subject to specific taxation for corporate income tax (IS) and value added tax (VAT). For this, it is necessary that a commercial company is incorporated and that, in addition, the vehicle is used, fundamentally, for professional activities. It is essential that both points are duly accredited with the invoice.

On the other hand, business expenses can also include journeys in vehicles that do not belong to the company, as long as it can be shown that the employees have used them for this purpose: this includes fuel, but also parking.

The idea is clear: a car expense is deductible in the IS if it is used for the company’s economic activity, whether it is purchased or used in a car belonging to a third party. However, a new company will pay less percentage in the IS on the taxable base and an SME less than a large company.

Having said this, the following cases can be taken into account when applying tax deductions

1. Purchase of the vehicle

Buying a vehicle in ownership would imply an expense for corporate income tax purposes. Therefore, it would be simple: it would be included in this item and would be subtracted from the taxable base for the tax assessment. This applies equally to vehicles purchased in cash or in instalments.

Remember that the criterion is that the car is mainly for the business activity of the company. If it is not, and even if it was purchased in the name of the company, the Tax Agency may not accept the expense.

2. Renting o leasing

You can also deduct renting or leasing payments, since in both cases, we are talking about an expense.

However, leasing is a renting by instalments or, in other words, a business expense. It can be included directly in this chapter, without further ado. And, therefore, it will be accounted for in the company’s profit and loss account, reducing the tax base.

Leasing, on the other hand, is considered a hire purchase, and here there is a difference in taxation. Basically, it can be said that this investment would also be recorded, but, in some cases, the amount to be depreciated could be higher.

Leasing regime

When your company needs to acquire an asset and needs to finance its purchase, you always turn to leasing because of the tax advantages it offers.

This form of financing allows you to depreciate the asset more quickly and thus defer taxation for corporate income tax purposes, thus obtaining financial savings. In general:

- On the one hand, as with loans, your company will be able to deduct the interest portion of the leasing instalments as an expense.

- You can also deduct the cost recovery part (i.e. repayment of the principal), up to a limit of three times the maximum depreciation rate of the asset.

This limit is twice the maximum depreciation coefficient in the case of companies that are not small.

Vehicle maintenance costs

Vehicle maintenance costs will also be deducted as expenses in the taxable base, if they are owned vehicles. Everything that has to do with workshops, oil changes, tyre changes or any other operation will be included in this chapter.

Remuneration in kind for the vehicle

Your company provides remuneration in kind in the form of a company car, renewing the vehicles from time to time. If at the time of renewal you give the used car to the employee free of charge, charge at least the VAT…

100% VAT deductible on the purchase of a vehicle

If your company buys vehicles to lend to your employees, you can deduct the input VAT in full.

This applies whether they are used for business or private purposes:

- On the business use side, the vehicle is considered to be used for business purposes, and the VAT can be deducted as if it were any other asset acquired by the company.

- On the private use side, the transfer of the vehicle is considered to be the consideration for work carried out by the employee. Therefore, on this side the vehicle is also considered to be used for the activity.

Passing on of VAT on remuneration in kind

In any case, VAT on the remuneration in kind must be passed on to the employee.

See an example of the amount to be charged each month for a vehicle valued at €30,000 (including VAT) and where the private use is considered to be 60%:

| Concept | Euros |

| Monthly remuneration in kind | 300 |

| Taxable amount VAT | 248 |

| VAT to be passed on to the employee | 52 |

[20% x (30,000 x 60%)] / 12.

Remuneration in kind is valued including VAT, so applying VAT on €300 would double this tax.

The company must pay this VAT regardless of whether or not it requires the employee to pay it.