Questions and answers about Form 390

Patrick Gordinne Perez2024-12-01T07:09:57+00:00Form 390 is an information return which summarises the VAT transactions carried out during the year.

It is essential to ensure that the tax is correctly settled and to avoid discrepancies with the Tax Agency.

Its submission is compulsory for professionals and entrepreneurs carrying out activities subject to VAT, except in certain specific cases.

Compliance with the deadlines and requirements of this form is essential for maintaining a sound tax position.

Form 390 is essential for the tax authorities. The tax office works a lot with cross-referencing data and checks whether the data in one form matches the data in another form.

What is a Form 390?

Form 390 is an annual summary of the transactions related to Value Added Tax (VAT) that taxpayers carry out over the course of a tax year.

This form is essential to maintain fiscal control and transparency.

Definition and purpose

This is an informative return that summarises all the quarterly self-assessments filed using form 303.

It is essential for the correct settlement of VAT, allowing the Tax Agency to keep a detailed record of taxpayers’ economic activities.

Its main purpose is to corroborate that the annual data coincide with the settlements made during the year, thus providing a clear view of compliance with tax obligations.

Form 390 reflects both accrued and deductible VAT, facilitating the analysis of the tax situation of each taxpayer.

Differences with form 303

Form 390 differs from form 303 in several key aspects:

- Periodicity: Form 303 is a self-assessment that is filed quarterly, while form 390 is annual.

- Purpose: While form 303 allows for the periodic settlement of VAT, form 390 serves as a summary of these settlements.

- Content: The 303 includes specific information on the operations of each quarter, while the 390 compiles all this information in a single annual document.

Importance of Form 390 for taxpayers

Filing form 390 is crucial for taxpayers, as it ensures the correct alignment of tax data.

This is essential to avoid discrepancies with the Tax Agency, which can lead to revisions or financial penalties.

This form also allows taxpayers to have an overview of their operations in terms of VAT, which facilitates tax planning and the identification of future tax obligations.

Keeping proper records using form 390 contributes to more efficient and transparent tax management.

Who must file form 390?

The filing of form 390 is a key requirement for many taxpayers in Spain.

This tax requirement seeks to ensure the correct declaration of transactions subject to Value Added Tax (VAT).

Subjects obliged to file form 390

The obligation to file form 390 falls mainly on all those individuals and legal entities that carry out economic activities subject to VAT. This group includes:

- Self-employed persons operating under the general VAT regime.

- Small and medium-sized enterprises (SMEs).

- Entities that carry out operations subject to VAT tax.

It is important to note that any taxpayer who is obliged to file form 303, corresponding to quarterly self-assessments, must also file form 390 at the end of the tax year.

Exceptions and groups exempt from filing form 390

Not all taxpayers are obliged to file form 390. There are exceptions to be considered:

- Self-employed and professionals who pay tax under the equivalence surcharge regime .

- Professionals whose activity is exempt under Article 20 of the VAT Law, such as certain doctors, teachers or psychologists.

- Taxable persons who only lease urban real estate.

- Large companies and VAT groups with access to the registration books by the Inland Revenue.

Census of business people and economic activities

Taxpayers obliged to file form 390 must be registered in the census of entrepreneurs, professionals and withholders maintained by the Tax Agency.

This register allows proper identification of the economic activities carried out by taxpayers and ensures that they comply with their tax obligations.

Correct adherence to this register facilitates the filing of the tax return and ensures compliance with current regulations.

Landlords do not have to file form 390

Form 390

During the month of January, VAT taxpayers must submit the annual VAT summary to the tax authorities, declaring the total amount of sales and purchases made in the previous year.

Until 2014, lessors of real estate who charged VAT were also required to submit this form.

Well, this has changed:

- If the only operations for which you charge VAT are the leasing of real estate, you (whether you are an individual or a company) are no longer obliged to file form 390 this January.

- However, you are required to fill in additional information on form 303 for the last quarter (declaring your activity and the total volume of transactions carried out during the year).

- Therefore, if you do not file form 303 for the fourth quarter (because you have ceased trading), you must file form 390.

If the only transactions for which you charge VAT are property leases, you are not obliged to file form 390 (annual VAT summary).

Since 2014, entrepreneurs under the simplified VAT regime and companies or entrepreneurs who only rent out real estate have the option to stop filing the annual summary (form 390).

In exchange, in the VAT return for the last quarter of the year (form 303) they must complete the additional information established for these cases, between boxes 80 and 88.

How to file a Form 390?

Filing Form 390 is a process that must be carried out accurately and within the established deadlines.

Below is a description of the key aspects that must be taken into account when filing.

Deadlines for filing form 390

The deadline for filing form 390 is from 1 to 30 January of the year following the tax period being declared.

If 30 January falls on a Saturday or Sunday, the deadline is the following Monday.

It is essential to comply with the deadlines to avoid penalties or problems with the Tax Agency.

Ways of filing

Form 390 can be filed in a variety of ways, providing flexibility for taxpayers to comply with this obligation.

The ways of filing include:

Online filing.

The most commonly used option at present is the online filing of form 390.

To do this, it is necessary to access the Tax Agency’s help programme.

This method allows the form to be completed quickly and the return to be sent without having to travel.

It is essential to have a digital certificate or a PIN code to access the digital services of the tax administration.

In-person filing (this is very much in disuse).

Although the online option is the most common, it is also possible to file form 390 in person.

This involves going to a Tax Agency office with the form duly completed on paper.

Although it is an alternative, fewer and fewer taxpayers are opting for this method, given the rise of digital procedures.

Technical requirements and necessary documentation

In order to file Form 390, it is essential to have a number of documents and to comply with certain technical requirements. The necessary documentation may include:

- Identification details of the taxpayer, such as tax identification number and company name.

- Information on all transactions carried out during the tax year, including invoices and receipts.

- Information on quarterly settlements filed on form 303, which serves as the basis for the annual summary.

It is advisable to have all this information organised and at hand, thus facilitating completion and ensuring that no key data is missing.

Keeping meticulous records will help to avoid errors and discrepancies that could result in audits.

Completion of Form 390

It is very important to check that the quarterly VAT model 303 forms match the annual model 390.

The correct completion of form 390 is essential to guarantee its validity and avoid problems with the Tax Agency.

The steps necessary to complete this document are detailed below.

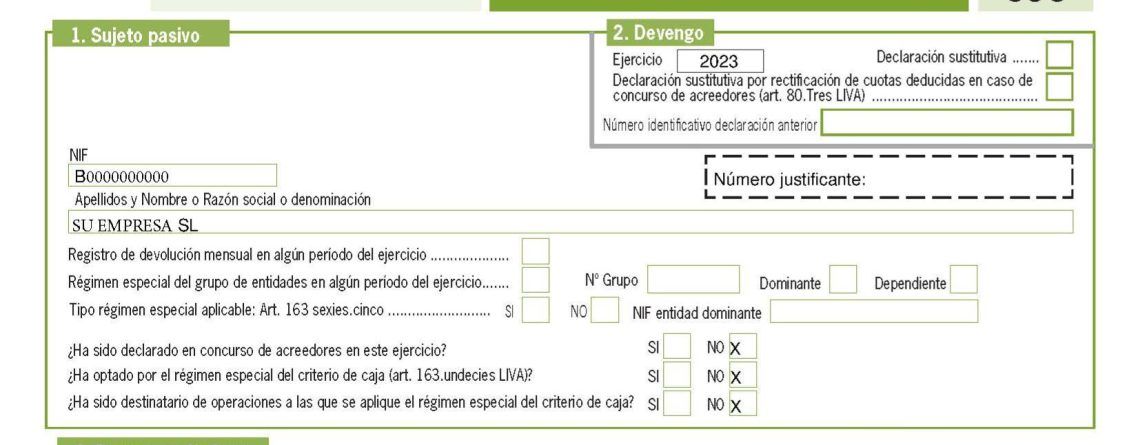

Identification and accrual data

In this section, it is essential to include the basic details of the taxpayer.

This includes the Tax Identification Number (NIF) and the name or company name of the self-employed person or company.

The corresponding tax year must also be indicated and, in the case of a substitute return, the reference number of the original return must be provided.

Record of activities and operations

It is necessary to detail all the economic activities carried out during the year.

The corresponding Economic Activities Tax (IAE) headings for each activity must be included here.

The information should be ordered from highest to lowest according to the volume of operations of each activity.

It is essential that this information is accurate, as any errors may lead to discrepancies with the quarterly self-assessments.

Accrued and deductible VAT

This section shows the tax that has been generated by the transactions carried out and the tax that has been deducted for the related expenses.

VAT rates applied

Taxpayers must specify the tax rates they have applied during the year: 4%, 10% and 21%. It is important to break down the VAT accrued according to each rate to ensure a correct subsequent calculation.

Calculation of deductible VAT

To calculate deductible VAT, all expenses incurred during the year must be recorded.

This amount is broken down by transaction and reflects the taxes that can be subtracted from the accrued VAT.

It is essential that expenses are properly documented, as any irregularities may lead to inspections.

Annual settlement and volume of transactions

Finally, it is necessary to reflect the result of the liquidation, which is obtained by subtracting the VAT deducted from the accrued VAT.

A summary of the total volume of transactions carried out during the year should also be included, which will be useful for any future review by the Tax Agency.

Common Errors and Practical Advice

Correct filing of Form 390 is crucial to avoid tax problems.

Below, we address some common errors that can arise, as well as practical tips to ensure proper filing.

Discrepancies between forms 390 and 303

One of the most frequent errors is the lack of concordance between the data included in form 390 and the self-assessments reported in form 303.

Discrepancies can lead to audits and penalties.

It is therefore essential to check both forms carefully before submitting them.

- Check that the totals of accrued and deductible VAT match on both forms.

- Check the classification of transactions and the tax rates applied.

- Make sure that the transactions registered in form 303 are correctly reflected in form 390.

Tips to avoid penalties

To minimise the risk of penalties, it is advisable to adopt some good practices during the preparation of form 390.

These tips can make it easier to comply with tax obligations efficiently and safely.

- Keep an organised file of all income and expenses throughout the tax year.

- Review quarterly returns regularly to identify possible errors prior to annual filing.

- Consult current tax regulations and be aware of any relevant changes that may affect filing.

Tax and Regulatory Implications

The correct filing of Form 390 has several tax implications that are essential for taxpayers’ tax compliance.

These implications are regulated by specific regulations that must be taken into account to avoid penalties.

Review and penalties for errors

The Tax Agency may carry out reviews of returns filed and, if errors are detected, penalties may be imposed.

Infringements can range from erroneous withholdings to significant discrepancies between form 390 and other tax documents.

Penalties can be classified as follows:

- Financial penalties, which vary according to the seriousness of the error.

- Surcharges on the amounts to be paid, if the error causes additional tax obligations.

- Late payment interest if there is a balance to be paid and there is a delay in payment.

This is why the correct completion and systematic review of the information submitted is essential to avoid negative repercussions.

Regulations applicable to form 390

Taxpayers must be aware of the regulations governing the filing of form 390. These regulations include, among others:

- Law 37/1992 on Value Added Tax, which establishes the general VAT rules in Spain.

- Royal Decree 1065/2007, which regulates tax returns and the procedure for obtaining data from taxpayers.

- The Tax Agency regulations that update the procedures, deadlines and penalties related to VAT compliance.

Being informed about these regulations ensures that professionals and companies comply properly with their tax obligations.

Adjustments and checks by the Tax Agency

The Tax Agency carries out adjustments and checks as part of its supervisory work.

These checks may be random or motivated by the detection of inconsistencies between the different models submitted.

During these checks, additional documentation may be required to verify the veracity of the data declared.

The results of these audits may lead to the regularisation of the taxpayer’s tax situation, which means that in case of irregularities, the outstanding tax obligations and the corresponding penalties will have to be paid.

Special Tax Cases

There are specific situations in which the VAT taxation rules may vary.

These special cases range from specific regimes to particularities in deduction and groups of entities. The most relevant aspects are detailed below.

Special VAT regimes

Special VAT regimes are designed to facilitate taxation and simplify the administration of the tax for certain economic activities. These regimes include the following:

- Equivalence surcharge regime: This regime applies to retailers who do not carry out any transformation on the products they sell. In this case, VAT is calculated with an additional surcharge on the sales price.

- Simplified regime: This is a regime for small businesses that allows VAT to be calculated in a simpler way, with a module system based on gross income and other indicators.

- Special regime for agriculture, livestock and fisheries:This regime allows producers in these sectors to apply a specific treatment in the VAT settlement.

Groups of entities and the equivalence surcharge scheme

Groups of entities may choose to consolidate VAT at group level.

This implies that each member of the group is subject to one and the same tax regime, which can simplify tax management.

In this context, the equivalence surcharge regime may also be applicable, providing tax benefits for retailers that are part of a group.

Differentiated deduction regimes

Differentiated deduction regimes apply to those activities that have specific treatments depending on the nature of the good or service.

Some examples are:

- Exempt activities: Some activities, such as those carried out by doctors or educators, may be exempt from VAT, which affects the deductibility of the tax.

- Mixed transactions: These involve both VATable and non-VATable activities, which complicates the calculation of deductible VAT and requires a detailed analysis of the transactions carried out.

It is essential that every taxpayer familiar with these regimes understands their implications and requirements for the correct completion and proper management of their tax obligations.

Additional Resources and Support

In order to facilitate the correct filing of form 390, there are multiple resources and support available.

These resources can help resolve doubts, provide useful tools and keep you up to date with changes in tax regulations.

Frequently asked questions and assistance

On the Tax Agency’s website, there is a section dedicated to the most frequently asked questions about form 390.

This section addresses key issues that often cause concern among taxpayers. Among the most common queries are:

- Deadlines for filing form 390.

- Documentation required for completion.

- Differences between forms 390 and 303.

- Consequences of late filing.

Telephone helplines are also available where tax experts provide guidance.

These services are particularly useful for resolving specific questions or clarifying particular situations related to the filing of the model.