EVERYTHING you need to know about the NIE number : (Foreigners’ Identification Number)

Patrick Gordinne Perez2025-02-16T05:22:34+00:00The Foreigner Identification Number, known as NIE number, is an identification document required for foreigners residing or carrying out administrative procedures in Spain. It is a unique and personal number that is used to identify foreign citizens in different legal and administrative aspects.

The NIE number does not change, if you lose it and need to request a new one they will give you the same NIE number.

Introduction: What is the NIE number and why is it important?

The NIE is issued by the National Police and is mandatory to carry out a series of procedures in Spain, such as opening a bank account, buying a property, purchasing a vehicle, contracting a telephone number, applying for work or residence permits, among others. It is also required in situations such as employment contracts or access to public services.

This document plays a fundamental role in the Spanish legal system, as it guarantees the proper control and registration of foreigners residing in the country. It also facilitates the identification and tracking of people in legal and administrative situations.

It is important to note that the NIE does not automatically grant any special migratory rights or status. However, obtaining it is a fundamental requirement to carry out various legal and administrative procedures in Spain. Therefore, any foreigner who needs to carry out procedures in Spain must obtain a Foreigner Identification Number (NIE).

How to apply for a NIE in Spain?

In Spain, the NIE (Número de Identificación de Extranjero) is an essential document for foreigners wishing to reside, work or carry out legal procedures in the country. Applying for the NIE requires following certain steps and complying with the requirements established by the corresponding authorities.

- The first step to apply for the NIE is to obtain an appointment at the Oficina de Extranjería (Immigration Office) or at the Police Station nearest to your place of residence. This appointment can be requested through the official website of the Ministry of Territorial Policy and Democratic Memory. Nowadays there are many problems in obtaining an appointment via the internet. In fact there are companies that charge a fee to give you an appointment.

An alternative to making an appointment in Spain is to make an appointment at the embassy of the country where you live,

Once you have made an appointment, you will need to collect the necessary documentation for the NIE application. The requirements may vary depending on your personal situation, whether you are European or non-European, but generally you are required to present

- The duly completed EX-15 form,

- Original and copy of identity card or passport (full passport for non-Europeans),

- A photo,

- Proof of the reason for which you are applying for the NIE (Purchase, work, studies, residence, etc.),

- Proof of payment of the 790 form fee and any other additional documents that may be required.

It is important to note that some specific procedures may require additional documentation. For example, if you are applying for the NIE as a student, you will also need to present a letter of admission to a Spanish educational institution and valid medical insurance.

Once you have gathered all the necessary documentation, you should go to the appointment with all the original documents and copies. There you will be informed about the next steps to follow and your application will be processed.

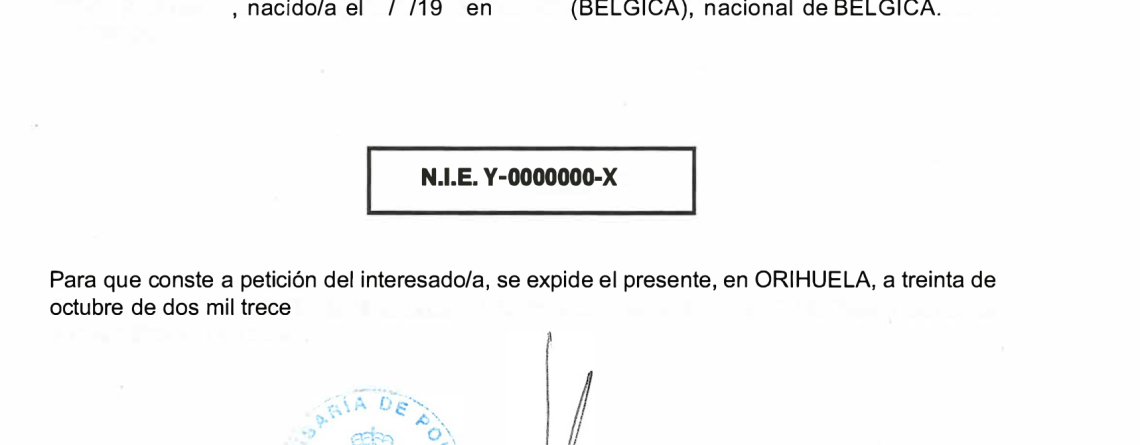

Normally you will be given the NIE at the time of application, but in some police stations you will have to return a few days later.

Remember that it is essential to comply with all the requirements and present the correct documentation to avoid delays or problems in the NIE application process. If you have any doubts, we recommend that you consult directly with the corresponding Immigration Office or Police Station.

Uses and benefits of the NIE in Spain

In Spain, the Foreigner Identification Number (NIE) plays a fundamental role in several aspects of everyday life. This tax identification number is necessary to carry out a number of legal procedures and formalities in the country.

One of the main uses of the NIE is to open a bank account. Both foreign residents and non-residents need this number to be able to carry out financial transactions and access banking services in Spain.

In addition, the NIE is required when buying or selling property in Spanish territory. It is a mandatory requirement to carry out any real estate transaction, either as a buyer or seller.

The NIE is required to buy a car, to register a service such as telephone or internet. If you want to apply for residency you must also have a NIE although the application for NIE and Residencia can be done at the same time.

Another benefit of the NIE is that it provides access to public services in Spain. With this number, foreigners can access public health care, obtain work and residence permits, as well as enrol in educational courses or universities.

In short, the NIE has multiple uses and benefits in Spain. From facilitating banking procedures to allowing the purchase or sale of property, as well as access to essential public services for foreigners residing or visiting the country.

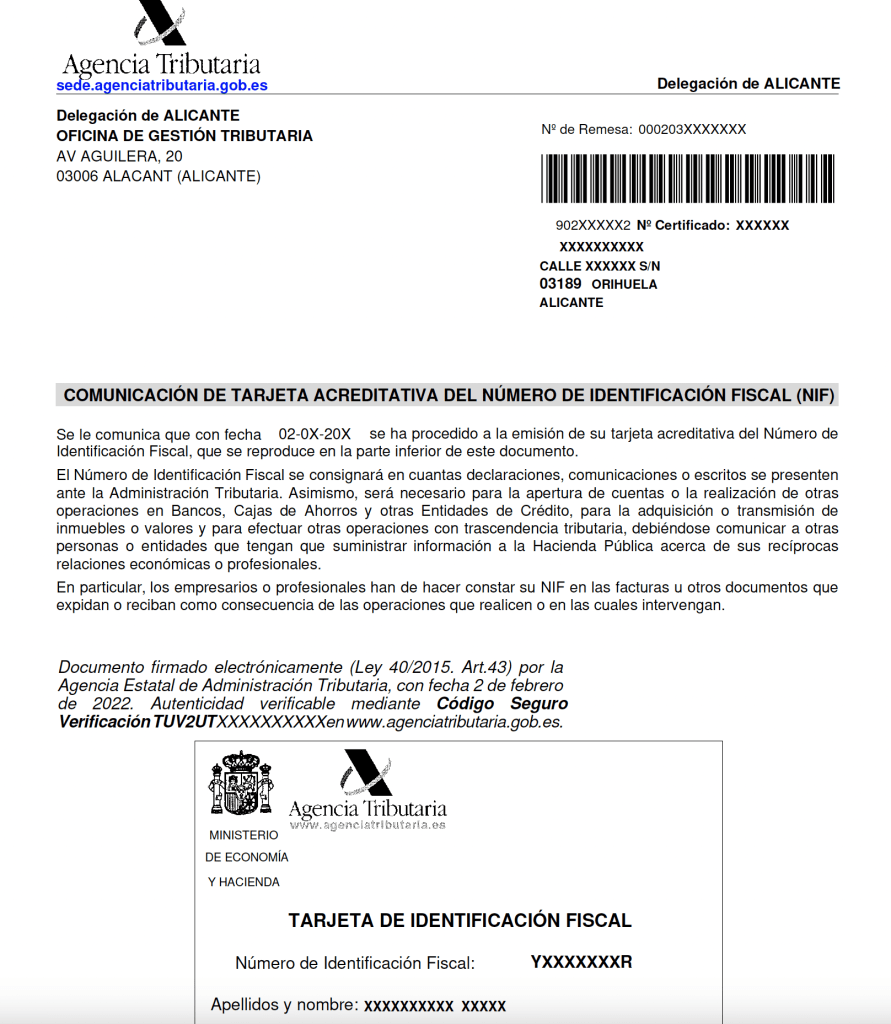

Differences between the Tax Identification Number (NIF) and the Foreigner Identification Number (NIE)

The tax identification number (NIF) and the foreigner identification number (NIE) are two terms that often cause confusion. Although both numbers are used for personal identification, there are important differences between them.

The NIF is a fiscal number used by Spanish residents to carry out procedures related to taxes, social security and other legal obligations. This number is assigned by the Tax Agency and is used to identify individuals and legal entities in Spain. The NIF can be assigned to both Spanish citizens and foreigners legally residing in the country.

On the other hand, the NIE is a foreigner’s identification number used by non-residents in Spain. This number is assigned by the Dirección General de la Policía and is mainly used for administrative and legal purposes, such as opening a bank account or signing contracts. The NIE allows foreigners to carry out formalities in Spain without the need for legal residence.

For individuals, the NIE is the same as the NIF, you only have to register the NIE with the tax office.

But for companies, it is the tax office that assigns you a NIF.

In short, while the NIF is used by Spanish residents for tax and legal matters, the NIE is used by foreigners not resident in Spain. Both numbers serve different purposes and each has its own scope of application within the Spanish legal system.

Frequently asked questions about the foreigner identification number (NIE)

In this section, we will answer some frequently asked questions related to the foreigner identification number (NIE). These questions include information about renewing the NIE, what to do in case of loss or theft of the NIE document, and how to make a change of address with regard to the NIE.

- How can I renew my NIE?

The NIE must be renewed before it expires. To do so, you must submit an application at the Foreigners’ Office corresponding to your place of residence. It is important to take into account the established deadlines and to have the required documentation to complete the process.

- Does a NIE expire?

No, the NIE never expires and it is very rare to have to renew it. Some government departments such as the DGT (Dirección General de Trafico) require the NIE to be less than 3 months old.

- What should I do if my NIE document is lost or stolen?

In case of loss or theft of the NIE document, it is necessary to report it to the competent authorities as soon as possible. Subsequently, you should request an appointment at the Oficina de Extranjería to obtain a duplicate NIE. During this process, you may be asked to present additional documents as proof of identity.

- How can I change my address with regard to the NIE?

If you have changed your address while in possession of a valid NIE, it is important to update this information in the Central Register of Foreigners as soon as possible. To do so, you will need to submit an application to the Foreigners’ Office corresponding to your new place of residence and provide the documents required to make the change.

Remember that these are just some common examples related to the foreigners’ identification number (NIE). If you have further questions or need additional information on this topic, we recommend that you contact us or the relevant authorities or consult official sources for the most up-to-date and accurate information.