Many customers ask us what their Spanish VAT number is, but in Spain, the VAT number for a natural person is their NIE number. Remember:

- The NIE number is the Numéro Identificacion Extranjeros (Foreign Identification Number) issued by the police.

- The NIF number is the Number of Identification Fiscal (Fiscal identification number) given by the Spanish tax authorities.

All you have to do is register your NIE number with the Spanish tax office and you will be given a NIF number or VAT number.

For companies, you must first register the company with a solicitor.

It may seem difficult for a company to navigate VAT numbers, but it is essential to understand the basics in order to do business in Europe. In this article, we will explain what a Spanish VAT number is and why it is important, how to obtain it and how to use it correctly.

Navigating VAT numbers can seem difficult for any business, but understanding the basics is essential for doing business in Europe. In this article, we will explain what a VAT for Spain number is and why it is important, how to obtain one and how to use it correctly.

For individuals

VAT number = NIE number = NIF number

For businesses

VAT number = NIF number

What is the VAT number?

A VAT number (Value Added Tax) is a unique code of 10 or 11 digits assigned to any company that has registered for the Value Added Tax of the European Union. The purpose of the NIF or VAT number is to make it easier for tax authorities and companies to monitor cross-border commercial transactions of goods and services. It is also used to identify in which country the purchase or sale was made, as well as other important information.

What is the NIF or CIF?

The NIF tax identification number or CIF tax identification code is precisely the VAT number.

In the past, a distinction was made between the NIF for natural person and CIF for legal person. Now the VAT number has been unified in NIF.

NIF of Individual Persons

The DNI of Spaniards (Individual Person) is their VAT number or NIF.

The NIE of foreigners (Individual person) is their VAT number or NIF.

NIF of Body Corporate

For Spanish companies or entities, the initial letter of the NIF of the Spanish Body Corporate will include information about their legal form:

- A Corporations

- B Limited liability companies

- C Collective societies

- D Limited Partnerships

- E Communities of property and lying inheritances and other entities without legal personality not expressly included in other keys.

- F Cooperative societies

- G Associations

- H Communities of owners in horizontal property regime

- J Civil societies

- P Local Corporations

- Q Public organisations

- R Congregations and religious institutions

- S Bodies of the State Administration and the Autonomous Communities

- U Temporary Unions of Companies

- V Other types not defined in the rest of the keys

The NIF of the companies or entities must be requested from the Spanish tax agency using the 036 model.

NIE = VAT NUMBER

Who needs to register to get a VAT number?

In general, any company that trades in physical goods or services to other companies based in the EU must register to obtain a NIF. It is mandatory by law, and if a company does not register it could face heavy fines and sanctions. Companies that are already registered in an EU country must show their full NIF on invoices from other countries that they send or receive as part of their commercial transactions.

How to get a VAT number?

Obtaining a VAT number is usually quite simple, although it varies from one EU country to another. In most cases, companies must request their NIF or CIF from the country’s local tax authorities, which requires companies to provide the relevant business information and some basic procedures. Once a company has registered to obtain a NIF in a country, it can use that same number in other EU countries if it does business on an international scale. The NIF or CIF can be requested with the digital certificate.

In Spain it is usually the notary who asks for the NIF of a Spanish company

Very important, it is necessary to register in the treasury the DNIs and NIEs that are not registered for this operation as a VAT number. That is, if you have never developed an activity or done anything for which the treasury has to be informed, the treasury does not know you and you will have to register your ID or NIE. This is the case of young people or foreigners.

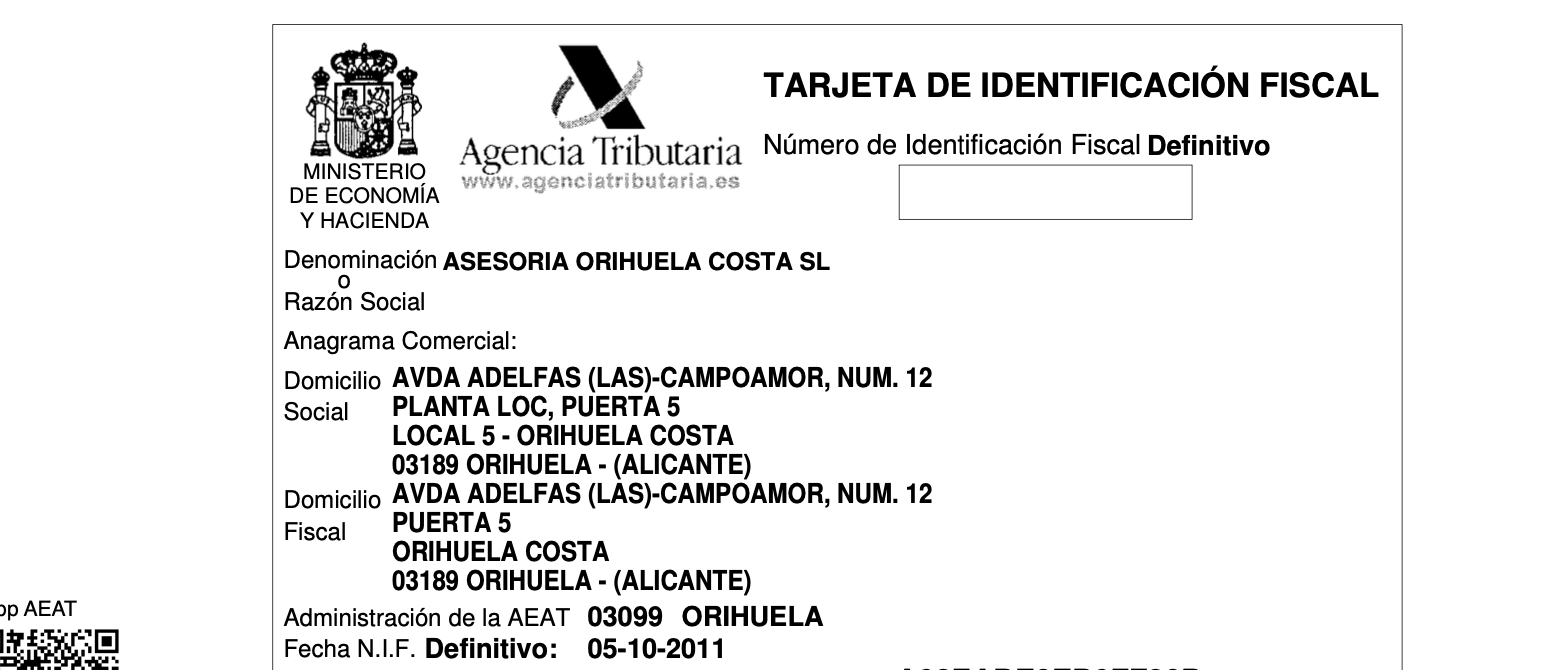

When setting up a company, the treasury is asked for the provisional tax identification number, which is the same definitive NIF and at the same time the VAT number of a NIF Company.

If a foreign company requests a VAT number in Spain, it will have to provide:

- Commercial registry certificate (Translated and apostilled) that the company exists.

- Powers of the person representing the company

- Nie of the company administrator

In Spain it is usually the advisor who asks for the NIF of a foreign company

What is the registration in the Roi Register of intra-community operators?

If your company buys or sells products or provides services in Europe and does not want to pay VAT, it must be registered in the ROI Intra-Community Operator Registry.

The application for the intra-Community Register of Operators is made through form 036 and the granting of the registration can take between 1 and 3 months.

You will have to provide the data of what activity you carry out, to which European companies you sell or buy, provide the deed or rental contract of the premises or place from which you carry out the activity.

If you do not perform any intra-community transaction for 6 months, the tax agency will remove the registration in the ROI.

Advantages of having a VAT number

Having a VAT number carries a number of advantages. The most important benefit is that companies can charge their customers in another EU country the required amount of VAT on sales, thus eliminating any financial responsibility of the company. It is an effective way to simplify and speed up the process of international trade.

In addition, having a VAT number also gives access to intra-Community acquisitions at zero rate. This means that companies can purchase goods or services from other EU countries without paying VAT, provided that they provide their supplier with their valid VAT registration number.

Implications of not having a VAT number

Not having a valid VAT number can have serious implications for companies. Companies may be required to declare and pay value added tax (VAT) in the country of sale if they sell goods or services to customers from other EU countries.

In addition, companies that have not registered to obtain a NIF run the risk of losing the intra-Community acquisition at zero rate mentioned above. It is therefore essential that companies ensure that they have all the necessary documentation (including a valid VAT registration number) before undertaking international trade activities.

Differences between the VAT number in Spain and in other European countries

Although the VAT system is common throughout the European Union, each country establishes particularities in the way of assigning and using this number. In Spain, the VAT number is directly linked to the NIF, while in other Member States different formats are used.

It is essential to know not only the VAT number of a company, but also how to verify the validity of the numbers of business partners in other countries. Misinterpretation can lead to incorrect invoicing with VAT, which in turn can lead to sanctions or the loss of the right to apply the intra-Community regime.

Verification of the VAT number in the VIES system

One of the key steps before issuing an invoice to a customer in another EU country is to make sure that their VAT number is valid. For this there is the VIES system (VAT Information Exchange System), a database managed by the European Commission that allows you to check in real time if the number provided corresponds to a registered company.

This verification protects both the seller and the buyer, since it guarantees that the operation is considered intra-Community and, therefore, can be invoiced without applying VAT. In addition, having confirmation through VIES is a way to demonstrate to the Tax Agency that the appropriate precautions have been followed.

In short, verifying the VAT number of a foreign company is not only a recommended procedure, but a practical obligation to avoid errors in the settlement of the tax.

Practical use of the VAT number on invoices

Beyond its legal importance, the VAT number fulfils a fundamental operational function in daily billing. Any invoice issued or received within the European Union must include this information, along with the tax information of both parties.

Their absence can invalidate the bill or generate problems in subsequent deductions, which is why many companies have incorporated internal procedures to ensure that each customer or supplier has a valid VAT number before closing a transaction. Even in national operations, reflecting it on invoices allows better accounting control and reduces incidences in tax inspections.

In short, the VAT number of a company is not a simple administrative code, but a key element in the traceability and validity of each operation.

Tax consequences of incorrect use

The misuse of the VAT number can have serious repercussions for companies. Issuing invoices with an invalid number or not registered in the ROI may involve the obligation to pay VAT that had not been passed on initially, in addition to economic sanctions. Likewise, deducting VAT fees incurred without having the verification that the supplier is correctly registered can be questioned by the Tax Agency.

These situations especially affect small businesses that do not have a robust tax department, for this reason, it is advisable to rely on a specialised advisor who guarantees correct compliance with the regulations.

Paying attention to something as apparently simple as the VAT number of a company can make the difference between efficient management and a conflict with the Treasury that ends in a fine.