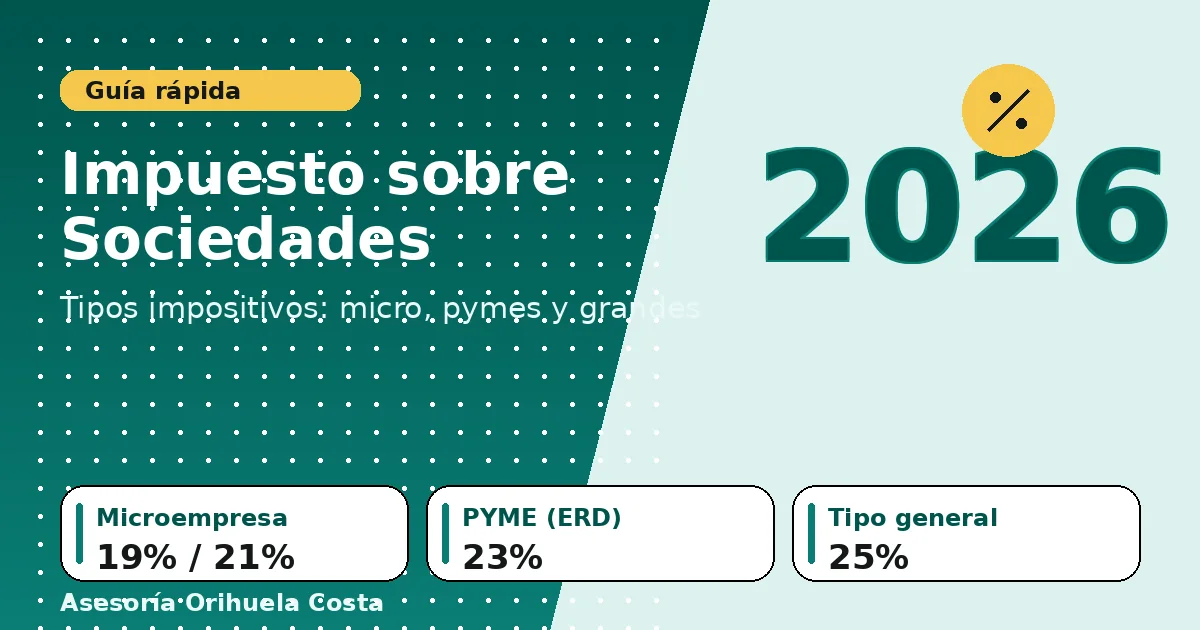

The Corporate Tax rate 2026 changes depending on the size of the company (microenterprise, SME/ERD or large company) and the time when the tax period begins. In this guide we explain which type corresponds to you in 2026, how it is determined by the INCN and what practical implications it has.

Updated: 12/24/2025

Author: Fiscal Team – Asesoria Orihuela Costa Advisory

Reviewed by: [Patrick Gordinne Perez], Economist (CEO)

In 2026 the Corporate Tax does not “reinvent the wheel”, but it does adjust the price of the toll to pay according to the size of the company. There has not been much talk about the reduction of the tax rates of the micro express in the coming years, but in Asesoria Orihuela Costa we have that it is very important.

The key is to identify its category or size (microenterprise, SME / Small Size Company or large company) and, above all, to understand a nuance that the Treasury loves: the important thing is when the tax period begins, not the year that appears on the calendar.

Below is a practical guide, designed for financial management and management: what type applies in 2026, how it is determined and what implications it has.

This article focusses on the rates applicable in 2026 (tax periods started in 2026).

In this link, you can know all the rates applicable until 2029 on corporate tax in Spain

1) What is "tax rate" and what is not

The tax rate is the percentage that is applied on the tax base to calculate the full tax share.

What is not:

- The “effective rate” (which can be reduced by deductions, negative tax bases BINs, fee bonuses, non-deductible expenses, etc.).

- The “minimum quota” or minimum taxation rules, which in some cases condition the final result even if the nominal rate is different.

2) How to know if your company is micro, SME (ERD) or large for IS purposes

In Companies, the practical classification or size of the company for the 2026 rate is based mainly on the turnover of the previous period, in other words, how much the company invoices:

Microenterprise (for these purposes)

- Turnover < €1,000,000 (with nuances and exclusions in specific cases, e.g. patrimonial entity).

- If your company invoices less than 1 million euros, it will be considered a micro-enterprise.

Fiscal SMEs (Reduced Size Entities – ERS)

- In general, turnover < €10,000,000 (art. 101 LIS). If your company invoices between 1 million and 10 million, it will be considered a reduce size entity.

Great company (in a practical sense)

- The one that does not fit in the previous cases (or exceeds thresholds), applying the general rate except special rates.

Useful note: if your year does not coincide with the calendar year, the applicable rate is that of the tax period that begins in 2026 (for example, fiscal year 04/01/2026–03/31/2027)

The size of a company is determined by the net amount of the turnover

3) Corporate Tax Rate 2026: table by size"

For “2026” we are talking about tax periods started in 2026.

Before seeing the table, remember that the Corporate Tax Rate 2026 depends on the INCN of the previous period and the start date of the year.

| Size of your company (fiscal criterion) | Type 2026 |

|---|

| 19% (0–50,000 € BI)and 21% (rest BI) |

| 23% |

| 25% |

These rates are included in the DT 44ª of the LIS (micro and ERD) and in the general tax rate

Direct reading on the tax rate of companies in 2026:

- 2026 is the year in which many SMEs go to 23% (in the transitional tranche).

- And micro-enterprises apply a 19%/21% scale according to the tax base. (Remember that we come from the 25% of just three years ago)

What changes with respect to 2024 and 2025 (to contextualise without cannibalising your post 2025)

For the reader to understand the “travel” (and why 2026 draws attention):

- In 2024 the AEAT shows 23% for micro-SMEs (without scaling), and in 2025 the transitional scale of 21% / 22%.

- In 2026, the scale for micro-enterprises drops to 19% / 21%.

- For ERS, in 2025 there is 24% and in 2026 it will increase to 23%.

(Translation into plain Spanish: in 2026 it is not that “there is a new tax”, it is that the rate changes according to size.)

4) Special rates that should be kept on the radar (also in 2026)

In addition to the “size”, there are entities with their own type. The most common:

- Newly created entities (which carry out economic activities): 15% in the first period with a positive tax base and the following. There are many people who do not know it, but if the people who create the company have exercised the same activity before, the new company cannot benefit from the 15% tax rate.

- Emerging companies (startups): 15% (according to regime requirements).

- Credit institutions: 30%.

- Hydrocarbons (exploration/research/exploitation): 30%.

- Tax-protected cooperatives: 20% (cooperative results, with particularities).

- Entities Law 49/2002 (non-profit): 10%.

- ZEC (Canary Island Special Zone): 4% (with requirements).

- SOCIMI: 0% (and special taxes in specific cases).

(Yes, 0% exists. But it’s not magic: it’s a regime with conditions and small print.)

5) Simple examples (to visualise the impact)

Example A — Microenterprise (INCN < 1M) with TB 80,000 €

- €50,000 × 19% = €9,500

- €30,000 × 21% = €6,300

Full fee: €15,800

Effective rate “before adjustments”: 15,800 / 80,000 = 19.75%

Example B — SME/ERD with TB 80,000 €

- €80,000 × 23% = €18,400

Example C — General rate with TB 80,000 €

- €80,000 × 25% = €20,000

Conclusion: in 2026, only by nominal rate, the difference between micro and general may be relevant.

6) Practical implications in 2026 that should not be forgotten

A) Watch out for the “start of the tax period”

If your company closes the year, for example, on 06/30, the 2026 rate applies to the year that begins in 2026, even if it is liquidated in 2027.

B) Installment payments (Model 202) and treasury planning

The nominal rate influences calculations and expectations of payments on account. In companies with tight margins, the scare is usually cash, not accounting.

C) Nominal rate vs. minimum quota / minimum taxation

For certain taxpayers there are minimum taxation rules (and exceptions) that should be reviewed before “celebrating” a deduction.

Typical mistakes that we see in our counselling

- To confuse “year 2026” with “year that begins in 2026.”

- Not detecting that an entity can be patrimonial (and then they change rules).

- Apply the 15% of “new creation” when the activity already existed in links or in the control partner (and then it’s time to regularise). And we don’t want finances to regularise us, right?

7) Checklist 2026 (quick and useful)

- Calculate your Turnover from the previous year and confirm category (micro / ERD / general).

- Check if it is a patrimonial entity (you can change the applicable rate in some cases).

- Remember that a patrimonial entity is a company that has no activity and that its asset is made up of more than 50% in real estate

- Plan closures and provisions: the tax is decided with numbers, not with good intentions.

- Review incentives and deductions (R&D, audiovisual, etc.) and fit them with applicable limits.

- Validate the type of your entity if you are in special schemes (cooperatives, ZEC, Law 49/2002, SOCIMI…).

- Align treasury with payments on account (avoid hard “eneroes”).

- Document criteria: when the Inspectorate asks “why”, it is convenient to have a written answer (and not just conviction).

If you want to quickly check what applies to you, these frequently asked questions summarise the Corporate Tax Rate 2026 for microenterprises, SMEs/ERD and the general rate.

8) Corporate Tax Rate FAQ 2026

What is the general rate of Corporate Tax in 2026?

The general rate is 25%.

What type applies to microenterprises in 2026?

For periods starting in 2026: 19% up to €50,000 of tax base and 21% for the rest.

What type applies to SMEs (ERD) in 2026?

For periods started in 2026, ERDs apply 23%.

What is meant by micro-enterprise for these purposes?

In this context, the INCN threshold < €1,000,000 from the previous period (with nuances) is used.

What if my exercise does not coincide with the calendar year?

It counts the year in which the tax period begins.

What type do you apply to start-up companies?

In general, 15% in the first period with a positive tax base and the following (if it meets the requirements).

Legal notice

Informational content. It does not constitute advice. Each company can have particularities (special regime, patrimonial entity, party exercise, group, etc.).