The extension is no longer a rumour or a “I’ve been told”: the postponement of Veri*Factu is approved. The calendar of the Regulation on billing computer systems (RD 1007/2023) has been modified by Royal Decree-Law 15/2025, of December 2, which modifies RD 1007/2023 and extends the deadlines for adapting billing computer systems (VERI*FACTU Regulation).

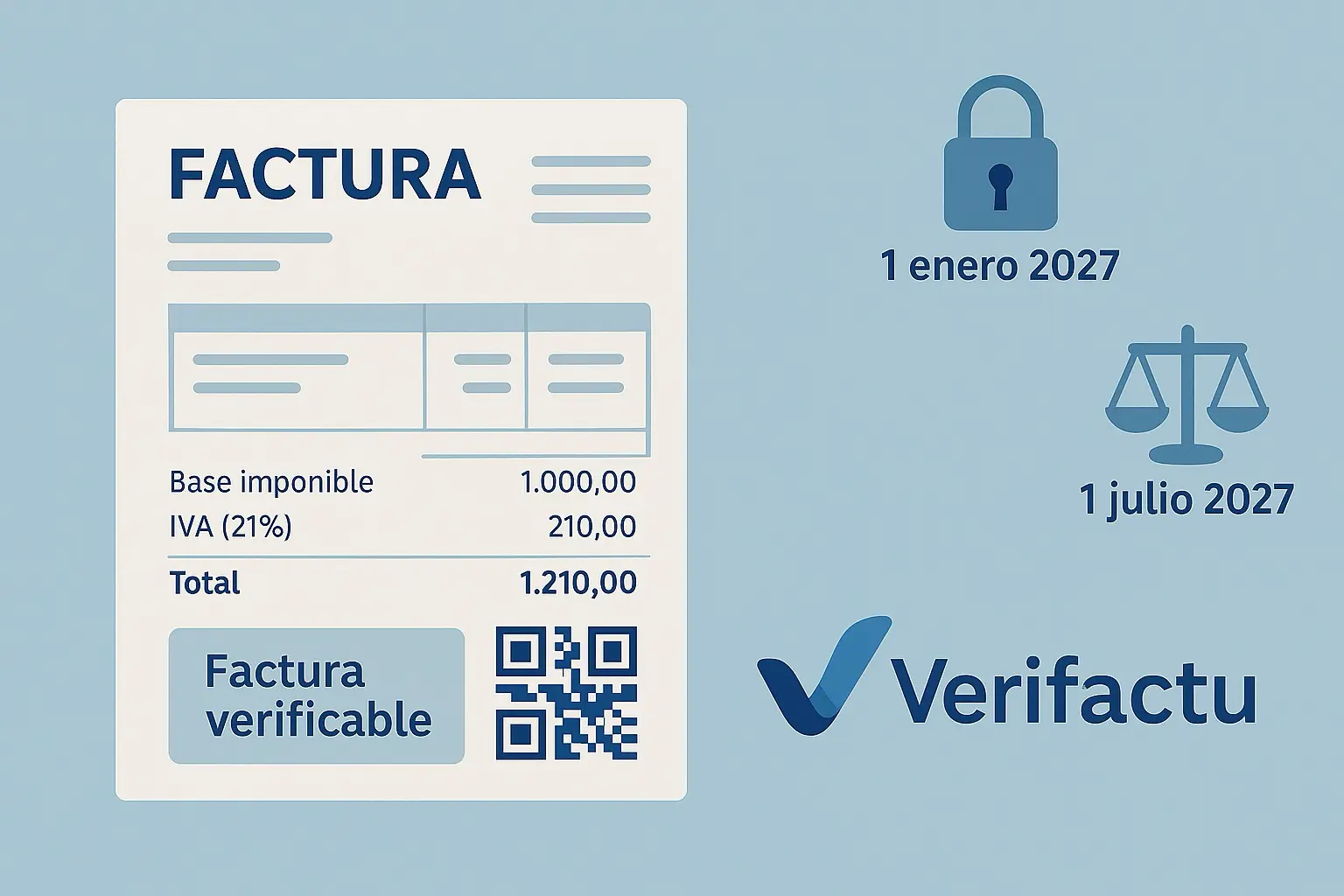

In practice, the obligation passes to 1/01/2027 for Corporate Tax taxpayers and to 1/07/2027 for the rest of the taxpayers (including many self-employed).

Yes. The postponement of the launch of Verifactu is official and has already been approved and published in the BOE.

VeriFactu is postponed to 2027: new dates and what to do from today

If in your company the “fiscal calendar” already looked like a series with too many seasons, here is a script twist with a reasonable ending: the postponement of VeriFactu (Regulation of computer billing systems) has been approved. The rule gives more room to adapt the billing programs, with the aim of making the implementation more organised and homogeneous.

New official dates (the important thing, without detours)

With the approved modification:

- Companies contributing to the Corporate Tax: mandatory adaptation before January 1, 2027.

- Other tax payers (many self-employed and SMEs): operating systems before July 1, 2027.

These dates are included in the regulatory change published in BOE and also explained by the Tax Agency in its information note

And yes: the key is in a word that in taxation is worth gold (and sometimes, sanctions): “before the“.

Official dates (and how to interpret them without "self-deception")

The rule literally states:

- Corporate Taxpayers (art. 3.1.a): they must have the systems adapted “before January 1, 2027”.

- Actual deadline: 12/31/2026 (at 23:59, if you want to be millimetric).

- Mandatory since: 01/01/2027.

- Rest of the obligations of art. 3.1: the operating systems must have “before July 1, 2027”.

- Actual deadline: 30/06/2027.

- Mandatory from: 01/07/2027.

The Tax Agency summarises it in the same terms (“before…”) and, in addition, clarifies that the previous period serves as a testing phase.

Important: "July 1, 2027" is not "only self-employed"

There is usually confusion here. The rule does not say “autonomous”, it says “the rest of the taxpayers mentioned in article 3.1“.

Who are they, according to article 3.1 of RD 1007/2023?

- Personal income tax with economic activities (autonomous, effectively).

- IRNR with permanent establishment in Spain.

- Entities in attribution of income with activity (e.g., communities of property).

Therefore, in practical language: it mainly affects freelancers, but not exclusively.

What does “VeriFactu” mean in practice?

VeriFactu is part of the requirements that invoicing computer systems (SIF) must meet to strengthen traceability and make it difficult to use software that allows invoices to be manipulated (“dual use”). The intention is to reduce fraud and underground economy and improve the quality of billing records.

What changes (and what doesn't change) with the postponement of Verifactu

Change: the calendar. One year of margin is gained compared to the dates initially planned, so that companies and technological suppliers can adapt systems with less improvisation.

Does not change: the direction of the trip. The path is clear: more controlled, more digital and more verifiable billing. In other words: it’s not a “goodbye”, it’s a see you later and “see you in 2027.”

Practical checklist to take advantage of the postponement (without falling asleep)

This margin is gold… if it is used well. Operational recommendation:

- Inventory of tools: invoice with ERP, local program, POS, Excel + template, online platform?

- Ask your provider (in writing):

- If your software is compatible with the requirements of RD 1007/2023 (SIF/Veri*Factu), The supplier has to give you a responsible statement.

- And when the update will be available.

- Review internal processes: billing series, rectifications, numbering control, discount policy, returns and monthly closures.

- Minimum training: that the team knows how to act when there are errors (rectification, traceability, evidence).

- Phased plan 2026 → 2027: tests first, then implementation. The goal is to reach 2027 with the “wheeled” system, not “newly released”.

“Postponed” does not mean “open bar to leave it for the day before“, because the day before usually coincides with… inspections, closures and holidays.)

Frequently asked questions

Is the postponement of Veri*Factu approved?

Yes. The modification of the calendar is published and explained by the AEAT.

What is the exact deadline for companies?

“Before January 1, 2027” ⇒ limit 12/31/2026; from 01/01/2027 it must already be adapted.

And for the rest?

“Before July 1, 2027” ⇒ limit 06/30/2027; from 07/01/2027 it must already be operational.

Does it only affect the self-employed?

No: it affects the “rest of the obliged of art. 3.1”, which mainly includes personal income tax with activity, but also other assumptions of the article itself.